Trump returns, with majorities in Congress, but his agenda may face a bumpy road

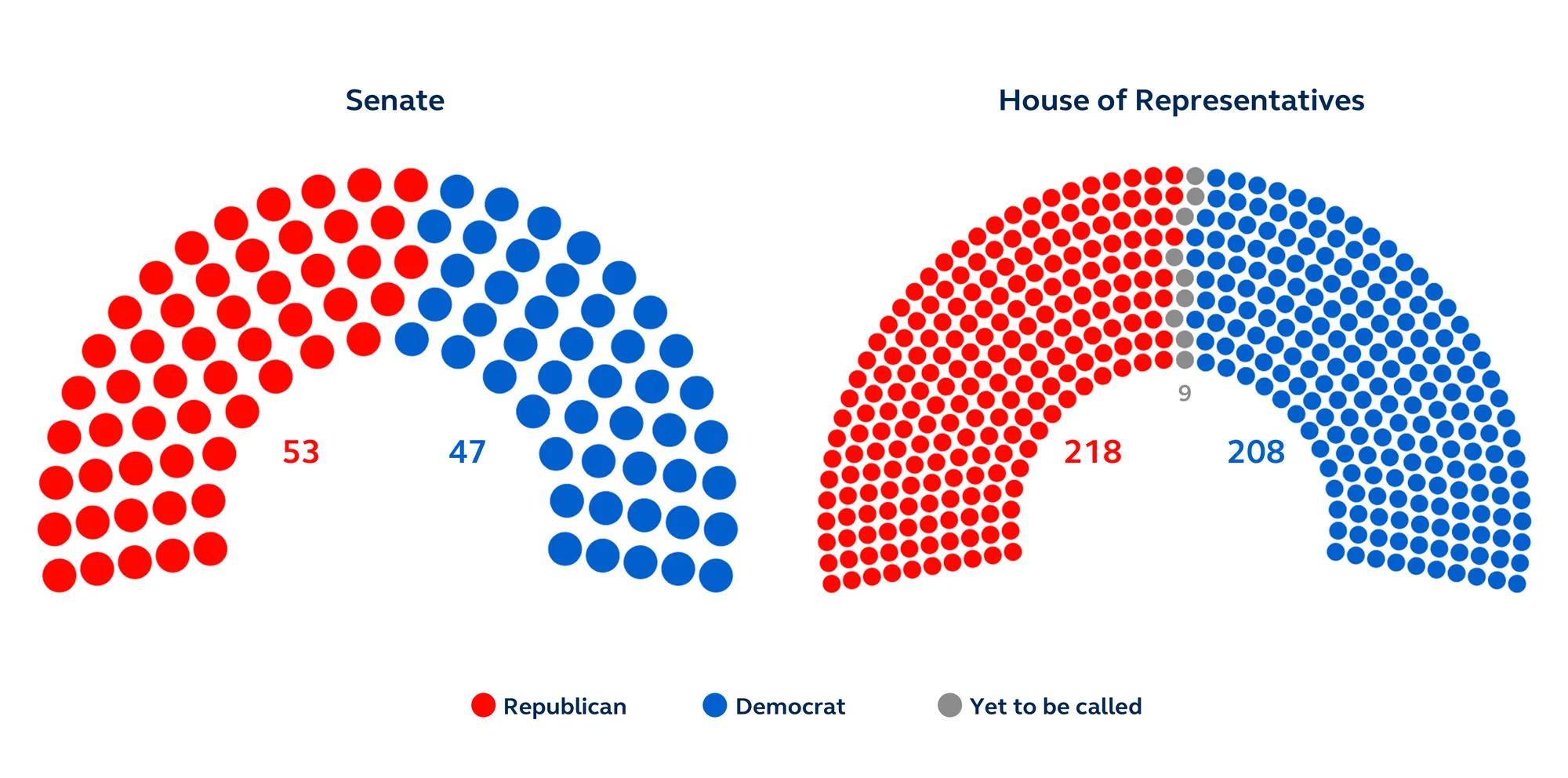

Despite initial concerns that the outcome of the U.S. Presidential election might remain uncertain for days or even weeks, as dawn broke on November 6, it was apparent that Donald Trump will return to the White House as the 47th President of the United States. Surpassing his support levels from 2016 and 2020, not only did he win the electoral college, but he also won the popular vote. Notably, a GOP sweep also materialized, with the Republicans capturing a majority in both the Senate and the House.

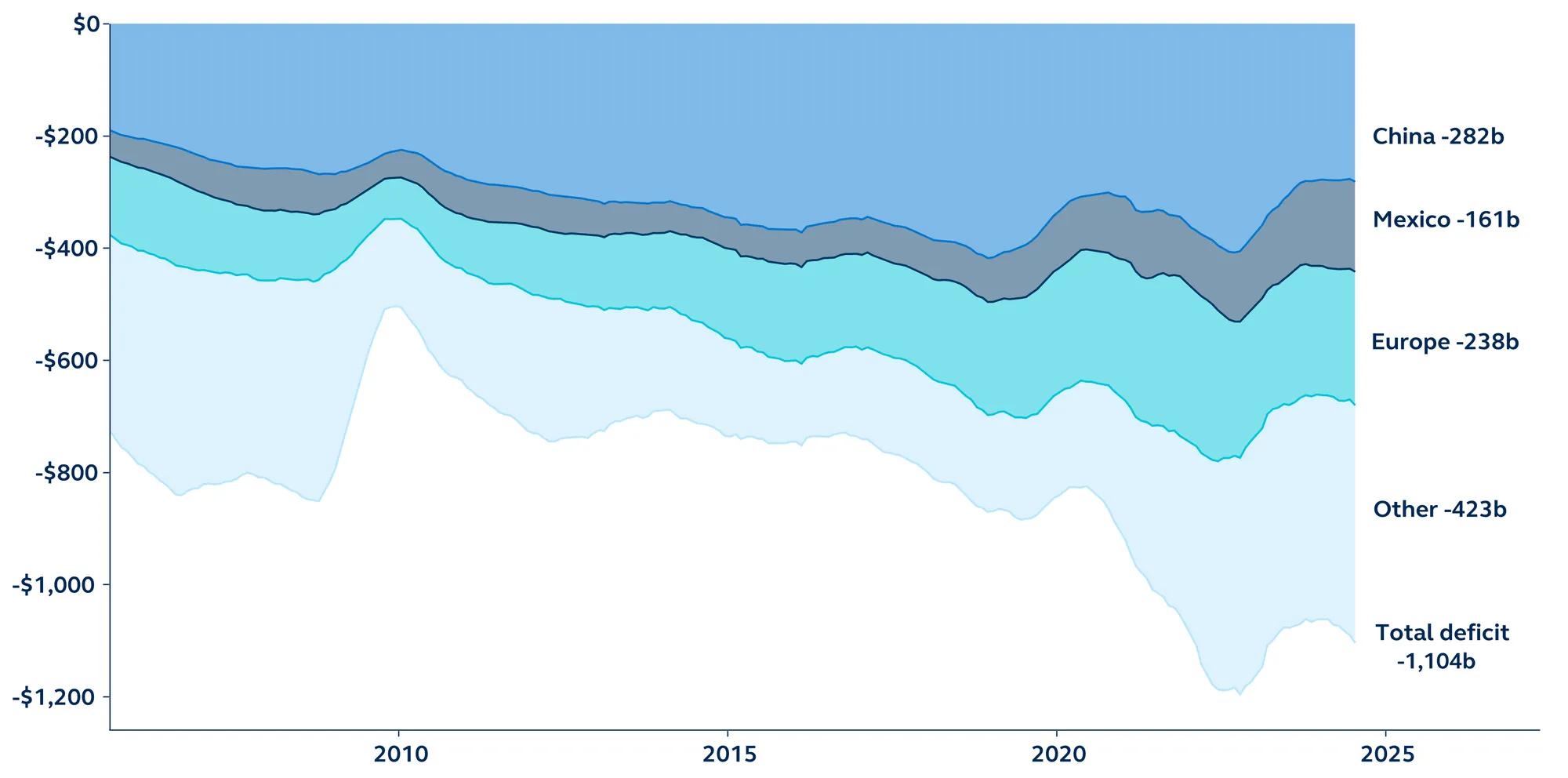

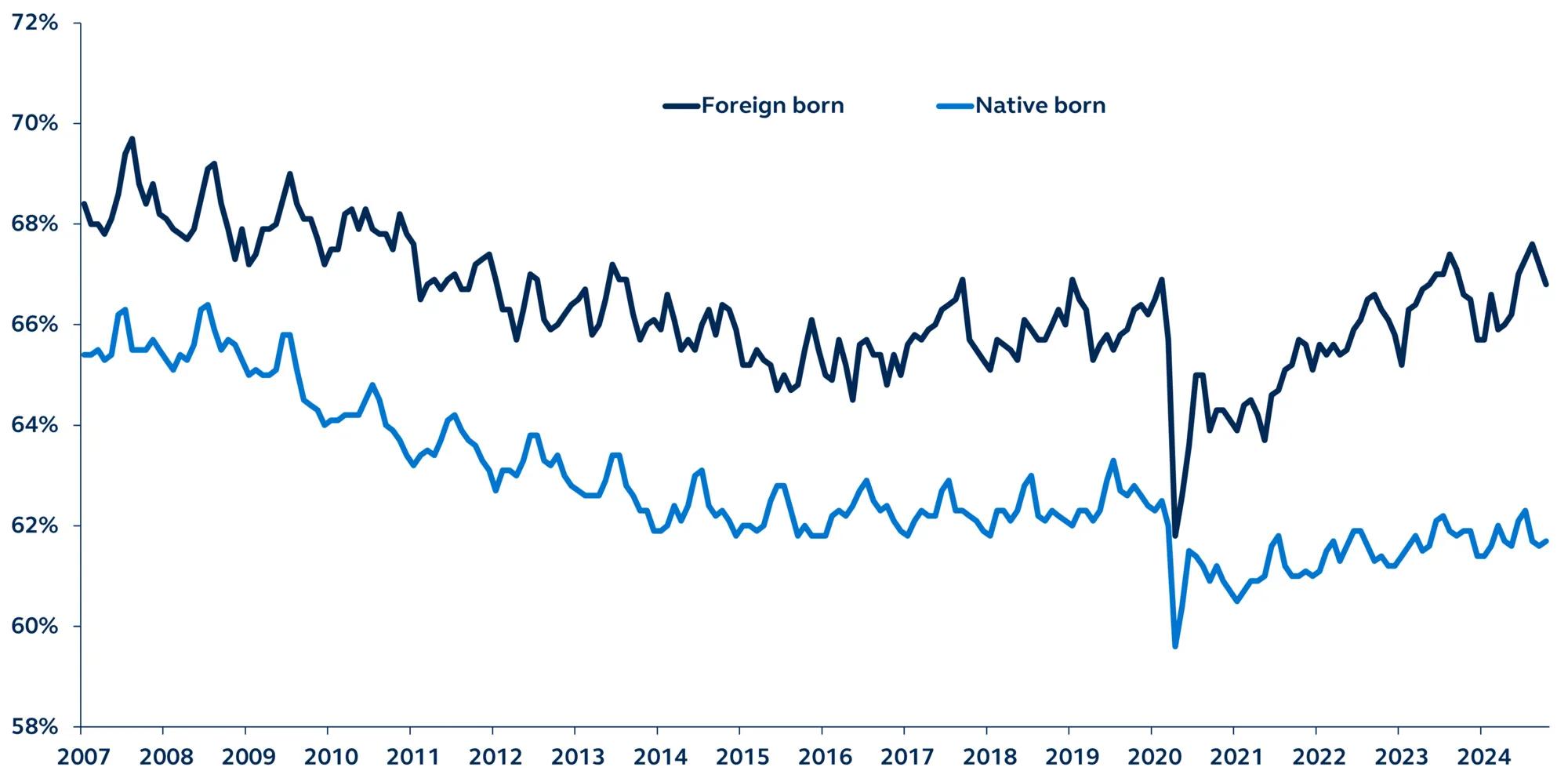

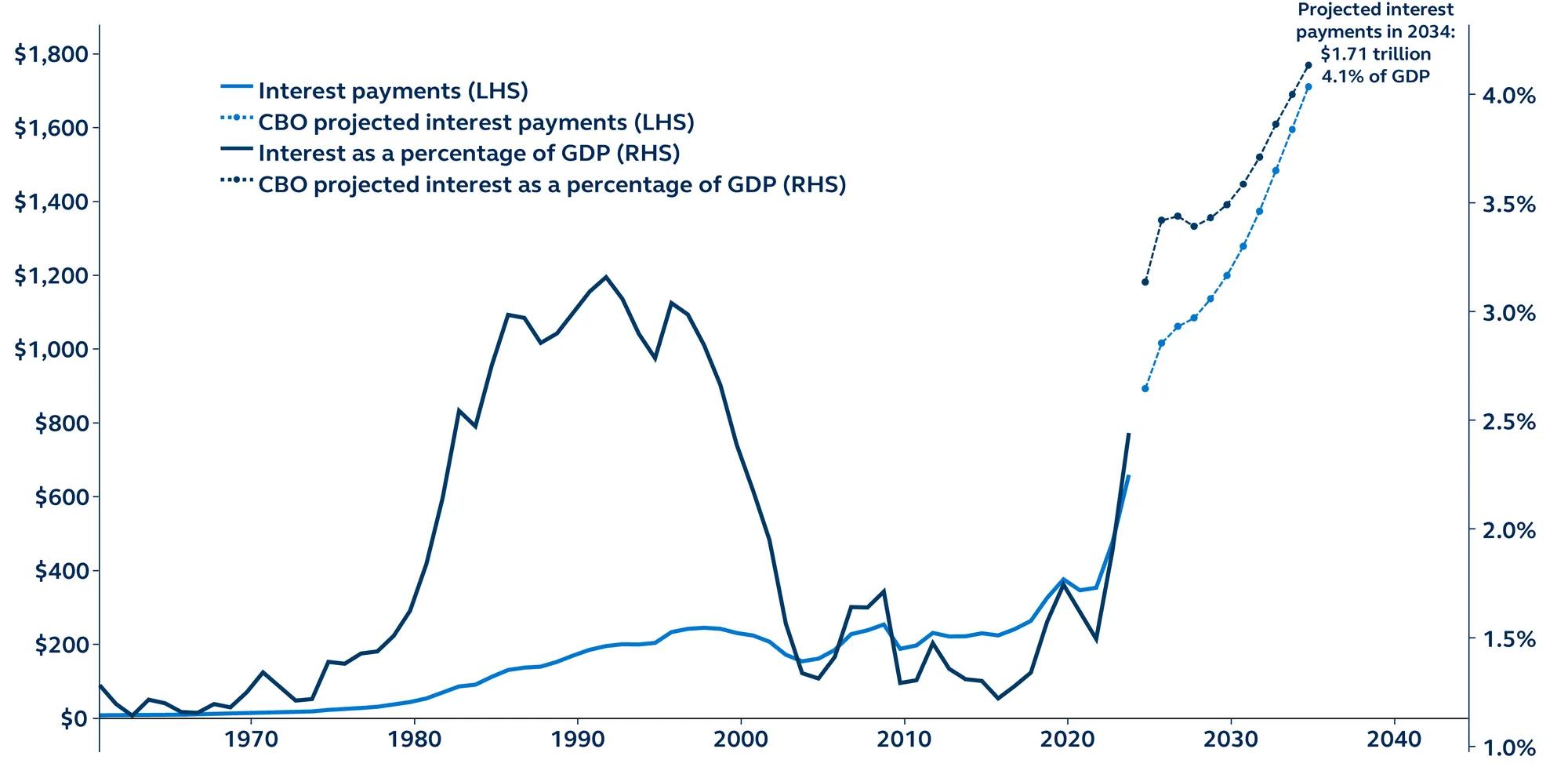

As a candidate, Trump outlined an ambitious policy agenda focusing on trade tariffs, tightening immigration, expansive fiscal policy, deregulation, and a retooling of geopolitical structures.

The narrow Republican majority in the House suggests a challenging path for many of President-elect Trump’s initiatives requiring Congressional approval, particularly those concerning tax and spending measures. Nonetheless, with the risk of a contested election now resolved, U.S. markets have responded positively: the S&P 500 has reached new highs, and yields have risen on expectations of tax cuts and increased fiscal spending. However, policy proposals do not always translate into concrete action, making policy execution the critical focus in the coming months.