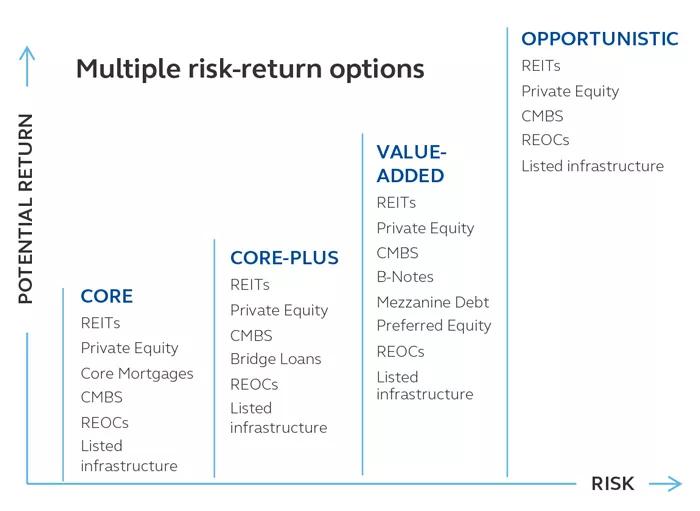

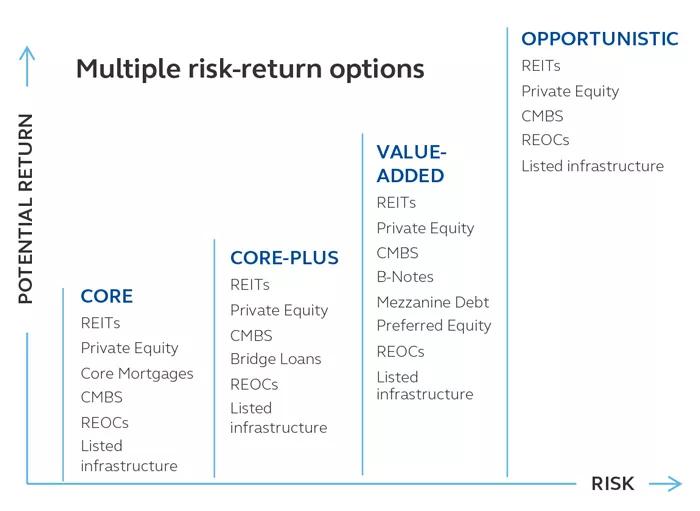

Executing across the risk-return spectrum

Experienced, global team of more than 300 real estate investment professionals dedicated to covering all four real estate quadrants.

Cross-team collaboration that leverages our distinct 360° perspective of real estate space and capital markets.

Coverage of approximately 50 U.S. metropolitan markets and management of over 200 assets across nine European countries.

We believe a combination of bottom-up analysis and top-down economic and sector research is key to delivering on our clients’ investment outcomes.

For illustrative purposes only and not a projection of returns to any investor. This information is intended to show a general risk profile and is based upon certain assumptions that may change. The characterization of the increasing risk is only made to illustrate the Firm’s view of the relative increasing investment risks inherent in these types of real estate investments. All are subject to various risks, none of which are outlined. An investor must be prepared to bear capital losses, including a loss of all capital invested.

Our experienced investment teams provide comprehensive, specialized, and sustainable capabilities across all four quadrants of commercial real estate—public equity, private equity, public debt, and private debt—as well as infrastructure investing. Whatever real estate strategy or combination of strategies you believe is right for your objectives, we can help.

Responsible Property Investing

Defined Contribution (DC)

Real Estate Operating Company (REOC) Investments

Our 360° view of global real estate gives us the insight needed to help you identify strategies that can offer compelling performance.

Principal’s High Yield Real Estate Credit seeks to provide current income, while aiming to preserve capital and mitigate downside risk.

Diversify your portfolio and enhance potential for risk-adjusted returns by accessing an exciting sector experiencing unprecedented growth as a result of digital transformation and global demand for data.

Offers exposure to the global infrastructure market, emphasizing research-driven stock selection as the primary driver of excess returns.

Applying bottom-up stock selection, emphasizing owning quality companies at a reasonable price, and diversifying sources of alpha generation.

Offers exposure to the global real estate market, applying bottom-up stock selection, emphasizing owning quality companies at a reasonable price, and diversifying sources of alpha generation.

Market-responsive, flexible strategy designed to move up and down the risk spectrum based on assessment of risk premiums relative to the outlook for longer term fundamental investment performance.

Deploying a research-based allocation framework with in-depth coverage of more than 40 U.S. metropolitan real estate markets to invest in a diversified pool of high-quality, well-leased U.S. commercial real estate properties, including a long-standing allocation to alternative growing pool of niche property sectors.

Combining the income-generating attributes of stabilized assets with higher, risk-adjusted returns available from value-added and development opportunities.

Targeting areas of distress in the European hotel sector to unlock and create value.

1There is no guarantee that this net zero target will be achieved.

Past performance does not guarantee future results.

Real estate investment options are subject to risks associated with credit, liquidity, interest rate fluctuation, adverse general and local economic conditions, and decreases in real estate values and occupancy rates.

Sustainability integration is considered across all actively managed asset classes, with the approach determined by each investment group’s process. This information is specific to the strategies managed by the individuals providing this content and various investment teams across Principal may have differing views of this approach.

Sustainability criteria may present additional advantages or risks and does not protect against market risks or volatility. You should not make any investment assumptions based solely on the information contained herein. There is no assurance that any Sustainability component in our investing strategy will be successful.

Principal Real Estate is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.