Emerging market debt (EMD) has garnered increasing attention from investors for many years. While the asset class has historically delivered attractive, diversified returns driven by high income generation, many investors still need help understanding how to approach it effectively. However, for those considering EMD investments today, despite potential short-term volatility stemming from geopolitical events, we believe the current environment presents one of the most favorable opportunities in the past decade.

The short-term EMD macro landscape has rarely been this favorable

The recent U.S. election has been a key factor of near-term volatility in EMD. However, like Trump’s first presidency, there may be a silver lining for a large part of the EMD universe. President-elect Trump’s likely weaponizing of tariff and trade actions will prioritize China, followed by Mexico, the EU, and potentially Southeast Asia—a region through which many Chinese exports to the U.S. have been rerouted since 2018. While China is expected to face significant tariffs first, Trump’s recent discussions with Mexico’s new president suggests that there are opportunities for other nations to negotiate deals in exchange for tariff clemency. Global investors also should note that debt issuers from regions like Latin America, the Middle East, Africa, Eastern Europe, Turkey, and the Indian subcontinent either largely remain outside of the scope of currently proposed U.S. trade actions or maintain favorable relations with the U.S.

While there were some initial concerns over widening U.S. deficits from proposed unfunded tax cuts, which could pressure the Federal Reserve to keep monetary policy tight, the nomination of Scott Bessent for Treasury Secretary (and the fact that there is ample market liquidity, eager to purchase U.S. T-bills) has eased some market angst. We expect that EMD flows will rebound in the new year, especially post-inauguration, once there is further clarity on policy and election-related EM volatility subsides.

The prospect of Trump’s presidency is also accelerating efforts to resolve ongoing global conflicts. In the Middle East, Israel's recent and decisive actions have pushed Iran into a defensive position, a shift that many Arab states quietly agree with. While risks of disrupted oil production in Iran and the Gulf remain, any disturbances are expected to be short-lived. Notably, Iran's weakened stance may lead investors to price in extended stability in the region, once the period of acute fighting in Lebanon and Gaza subsides. Similarly, in Ukraine, positions on both sides have started to shift towards the need for some form of cease-fire, though skepticism about the durability of any agreement remains high.

Finally let’s not forget that three of the world's major central banks remain in easing mode—the Fed, the European Central Bank and the People's Bank of China—providing liquidity support to risk assets and the aggregate global economy. Easier monetary policies and a possible soft landing of the U.S. economy (consensus forecasts point to 2% growth for 2025 vs. 3% for 2024) should revive appetite for emerging markets debt through improving global financial conditions, and stabilization in the very strong recent USD move. That, coupled with ultra-low global positioning, the perception of EMD offering widespread risk diversification, an attractive income stream, and more “value for money” versus the actual risks, in a world of richly valued developed market (DM) equities and credit assets, should support interest for EMD. This should continue to create conditions for a “grind tighter” in credit spreads and a progressive top in USD strength, allowing for a combination of a 7-9% income stream and some capital gains into 2025. Market participants may be wise to reallocate to EMD strategically through any dips ahead of and immediately after the passing of the New year.

Complexity can be a challenge

Most international fixed income segments are in some way a blend of sovereign USD credit, corporate USD credit, and local currency sovereign bonds. But EMD adds additional layers of complexity, making it one of the most tangled global asset classes available to retail and institutional investors. It is influenced by global macro developments (including U.S., European, and Chinese economic activity, commodity markets, and global liquidity conditions) as well as the bottom-up idiosyncrasies of individual developing countries and corporates that offer a variety of macro situations, political wrinkles and business models.

Complexity plays out technically, too. There are many types of global investors interacting in EMD, ranging from domestic to international investors, mutual funds, pension funds, sovereign wealth funds, insurers, hedge funds, etc., each with their unique risk and return considerations, investment biases, and time horizons.

Emerging markets often grab attention with dramatic headlines, which can paint a picture of instability. From sudden defaults and financial crises to political unrest and ESG mishaps, these issues can make it challenging to reassure investment board members or clients about the merits of investing in these regions.

Adding to the difficulties, the last five years have been tough for all fixed income asset classes. Emerging Market Debt has been especially volatile, impacted by various challenges, including the COVID-19 pandemic, rising inflation, aggressive central bank tightening, and ongoing geopolitical tensions and conflicts.

Negative sentiment has left EMD under-owned

As a result of the challenging and volatile conditions of the past few years, investors redeemed their emerging market debt holdings throughout 2022 and 2023, in the largest outflow since 2008. Furthermore, despite the recent global surge in demand for fixed income, global investors have remained spooked by EMD and have stayed on the sidelines since late 2023, resulting in the asset class being deeply under-owned. Once investors recognize the more constructive fundamental backdrop for EMD assets, however, the under-owned nature of the asset class could be a favorable technical factor for the sector.

In fact, the fundamental picture of EMs ex-China has been remarkably resilient, with growth trending around 3.0-3.5% annualized, yoy, for 2024, up from 2.5% in early 2023. Inflation challenges in many EMs were also contained earlier than in most DMs, thanks to a much more decisive tightening by EM Central Banks starting in early 2021. Additionally, commodity prices have remained in a “Goldilocks” trading range for EM countries, and fiscal balances remain broadly sound, supporting many EM economies. Despite prospects of lower oil prices into 2025, oil between $70-$80/bl is not too expensive to cause a balance of payments challenge for importers, while not being so cheap for exporters so that it causes major fiscal pressures. With Federal Reserve rate-cutting cycle coinciding with a measured slowdown in U.S. activity and a much brighter environment for EMD may be on the horizon.

Income should remain the driver of EMD returns

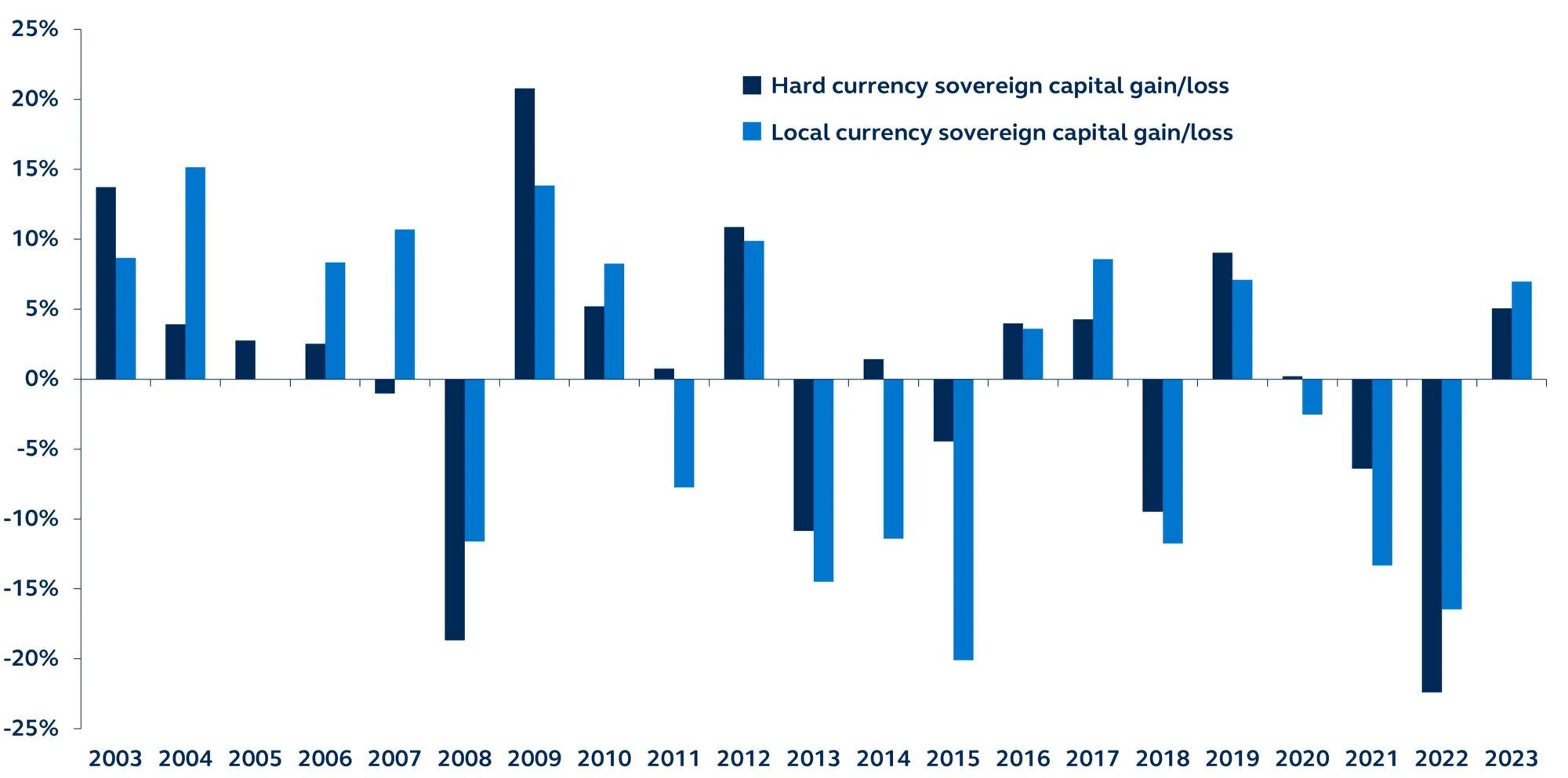

For many investors, the conventional path into EMD, through benchmarked funds or ETFs, has not recently yielded significant rewards. In fact, over the past two decades, while investors have earned an attractive and diversified income stream, this has been accompanied by substantial volatility, including numerous instances of capital loss.

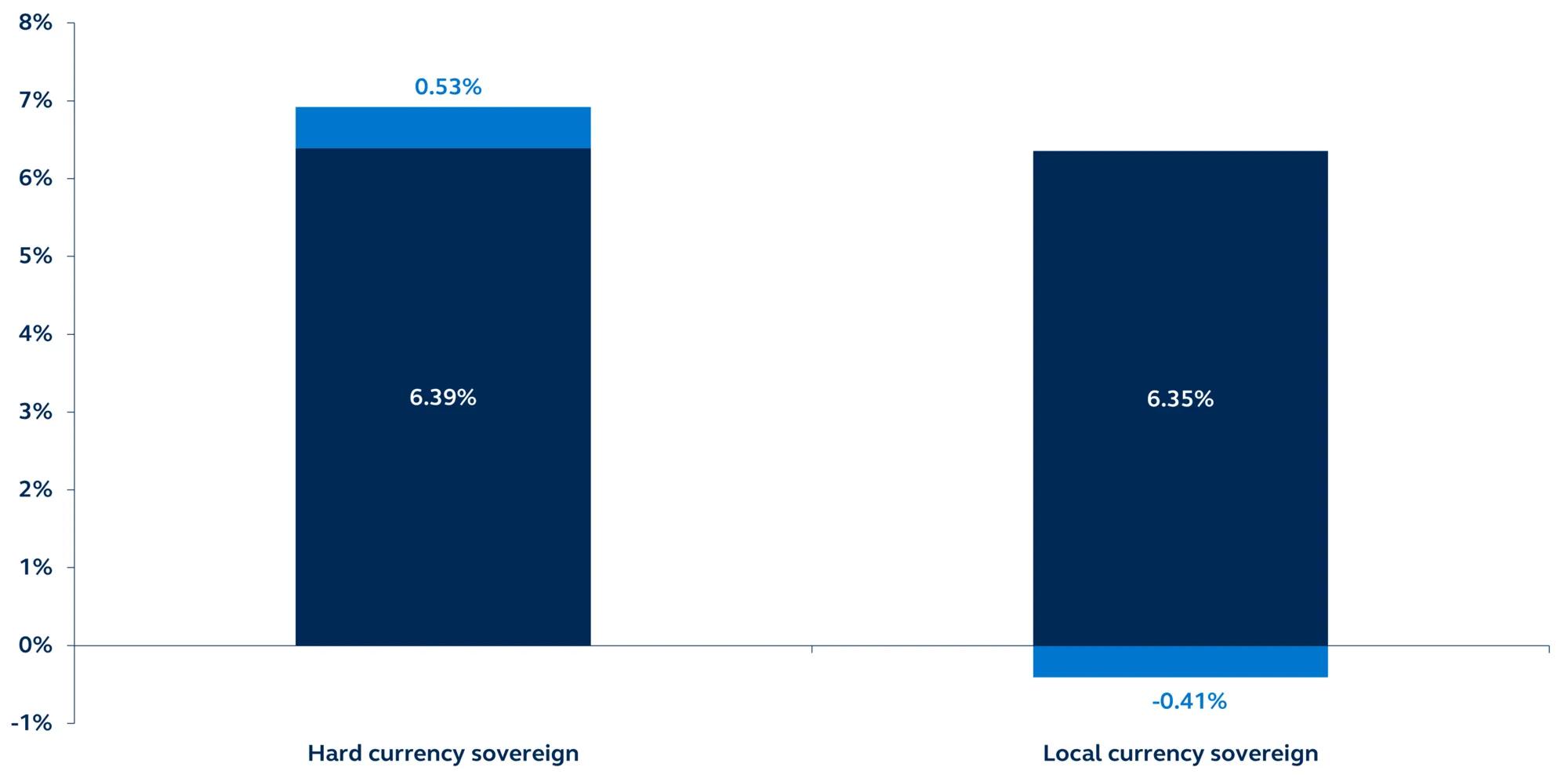

Consider that since 2003, the income generated by the JP Morgan EMBIG Div Sovereign USD index and the JP Morgan GBI-EM Local Currency Bond index has, on average, accounted for nearly all of their annualized returns, while the price components of those indices have been relatively trendless.

As the income stream has remained relatively stable despite declining global bond yields and given that EMD indices have shown significant volatility and little to no capital gains over the past 20 years, looking ahead, delivering that income should remain the anchor of returns in both hard and local currency assets.