Countertrend rallies are characteristic of secular bear market downtrends, and from that perspective, 2022 has been remarkably similar to previous bear markets in history. Until inflation abates and the Federal Reserve rebalances its priorities away from inflation and toward growth, tempting rallies are likely to remain unsustainable.

Bear market rallies

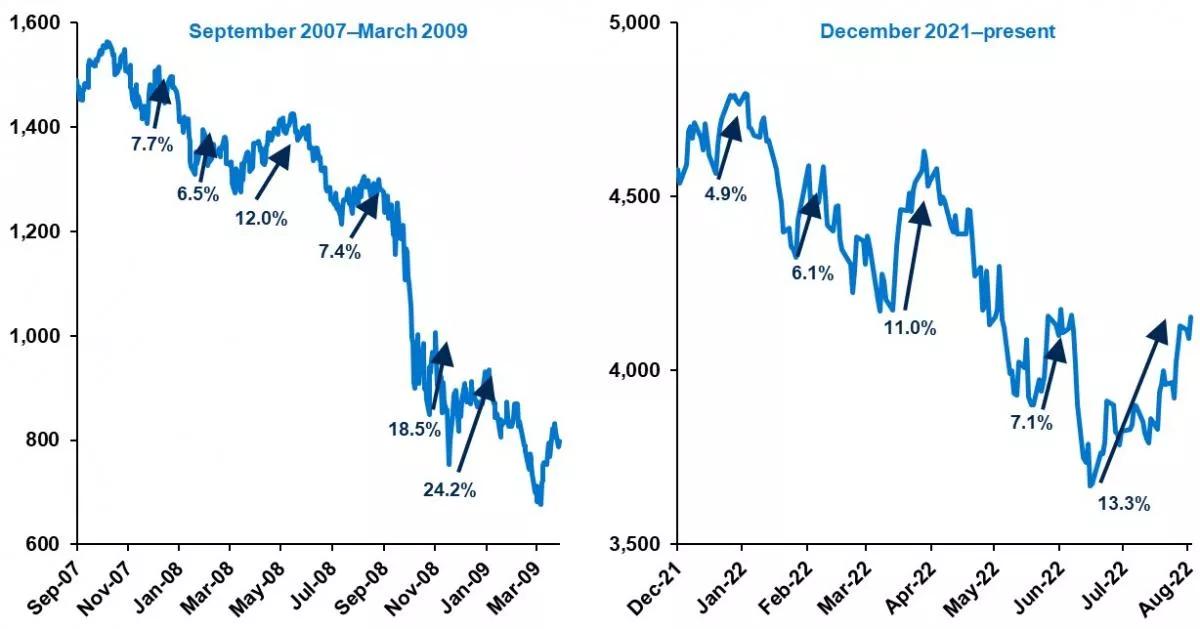

S&P 500 level, annotations highlight percent gain from the beginning to the end of each bear market rally

Standard & Poor’s, Bloomberg, Principal Global Investors. Data as of August 3, 2022.

Bear markets—equity market declines of 20% or more—are typically littered with volatile trading ranges which exhibit lower highs and lower lows. Bear market rallies, therefore, are the short-lived upward trading ranges during such secular declines, whereby technical factors drive markets higher for a temporary period, before deteriorating fundamentals reassert themselves, prompting renewed equity market declines.

The increase in European gas prices has been particularly sharp. Since January 2021, natural gas prices have risen almost 760%, significantly more than the 240% increase seen in the U.S. The surge is deeply impacting Europe’s economy, pushing inflation to record highs, driving up household bills, and straining Europe’s industrial sector.

The protracted down markets of 1973-1974, 2001-2003 and 2008-2009 each experienced multiple bear market rallies, while this year’s bear market has experienced five through August. The latest, starting in mid-June, has seen the year-to-date equity market decline diminish from 24% to just 13%. While this represents a sizeable gain, it is, in fact, exactly in line with the average magnitude of bear market rallies in previous cycles.

Just like the previous four rallies this year, the current one is unlikely to be sustained. Core inflation remains very elevated and will decline only slowly and, with the Fed continuing to emphasize prioritization of inflation curtailment over growth concerns, significant further monetary tightening is likely. As the economy slows, earnings downgrades may also precipitate a re-evaluation of the current market rally.

2022 is proving to be a typical echo of previous bear markets in history—including the hopeful, yet inevitably humbling, temporary rallies. Until fundamentals improve, investors should not place too much faith in sharp, but temporary, bear-market rallies.

Wall Street Journal Custom Content is a unit of The Wall Street Journal advertising department. The Wall Street Journal news organization was not involved in the creation of this content.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

For Public Distribution in the United States. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and services marks of Principal Financial Services, Inc., in various countries around the world.

Principal Global Investors leads global asset management at Principal.®

2339857