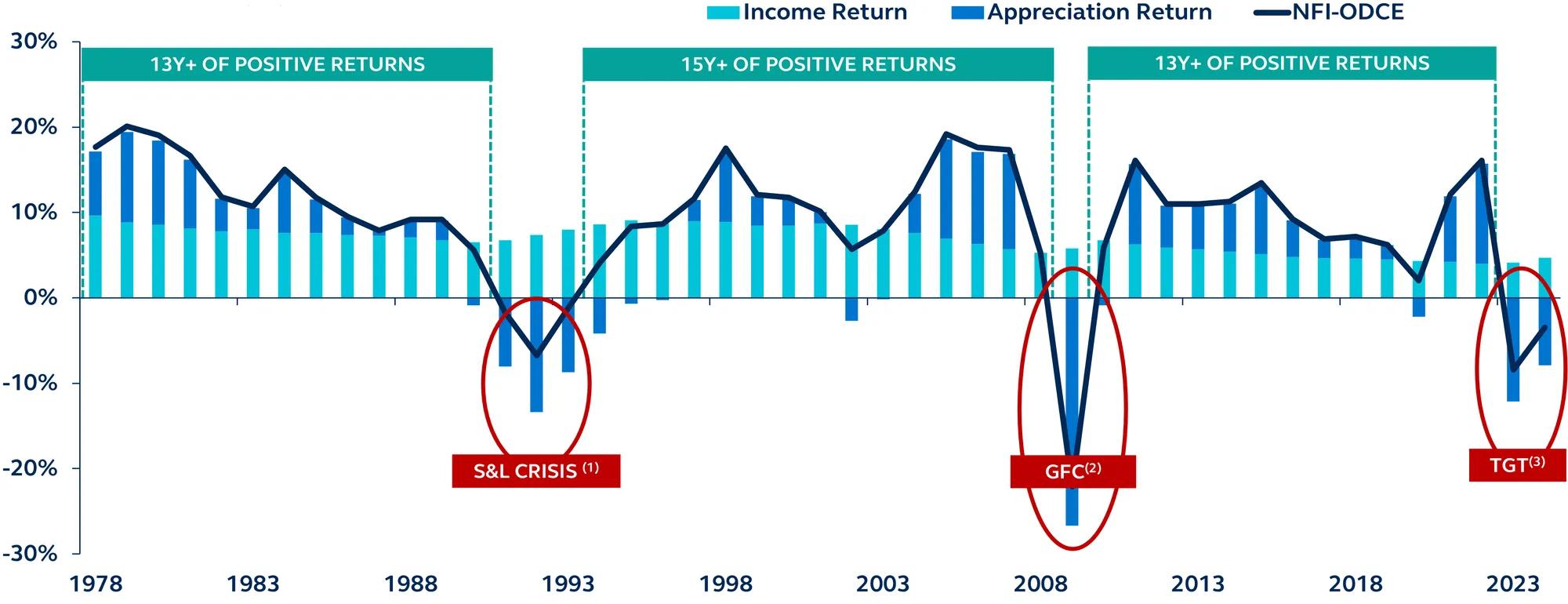

One hallmark of commercial real estate is its relative stability through cycles, with roughly two-thirds of total returns historically derived from income. Historical trends show recoveries averaging 13 to 15 years, and with credit conditions improving and valuations stabilizing, the market is primed for another growth cycle. Investors focusing on structurally strong sectors like data centers, logistics and residential can position themselves to potentially benefit from this turning point.

Historical performance—NCREIF annual returns

U.S., percentage, 1978-2024

Commercial real estate (CRE) stands as a testament to resilience and long-term value, with a track record of relative stability through economic cycles. Over the past 45 years, CRE has experienced only five years of negative returns, bolstered by the consistency of income, which contributes approximately two-thirds of total returns. This income-centric profile underscores the asset class's reliability, even during periods of market volatility.

The past two years have challenged the CRE market, marked by higher interest rates and shifting valuations. However, moving into 2025, the stage is set for a recovery. Stabilized credit conditions, improving demand, and a moderation in borrowing costs signal a turning point. Historically, recovery phases in CRE have spanned 13 to 15 years, with annualized returns averaging 11%, suggesting that the coming year may mark the beginning of another lengthy upward cycle.

Investors should focus on sectors with strong structural drivers, such as data centers, residential, and logistics, which continue to experience strong demand. These areas benefit from trends like digitalization, positive demographic shifts, and the reconfiguration of supply chains, providing compelling growth opportunities.

Prevailing disinflationary trends are also fostering a more favorable environment for investment. Central banks, shifting toward accommodative policies, are paving the way for increased capital flows and improved market sentiment.

With its historical ability to deliver stable returns and navigate economic shifts, CRE remains a potential cornerstone for investors seeking durable income and long-term growth.

For a deeper dive into commercial real estate’s prospects and its implications for investors and portfolios in the period ahead, read our 2025 Inside Real Estate Outlook: Poised for growth.

Investing involves risk, including possible loss of Principal. Past Performance does not guarantee future return. All financial investments involve an element of risk. Therefore, the value of the investment and the income from it will vary and the initial investment amount cannot be guaranteed. Potential investors should be aware of the risks inherent to owning and investing in real estate, including value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk. All these risks can lead to a decline in the value of the real estate, a decline in the income produced by the real estate and declines in the value or total loss in value of securities derived from investments in real estate.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2025, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

4182559