Report details

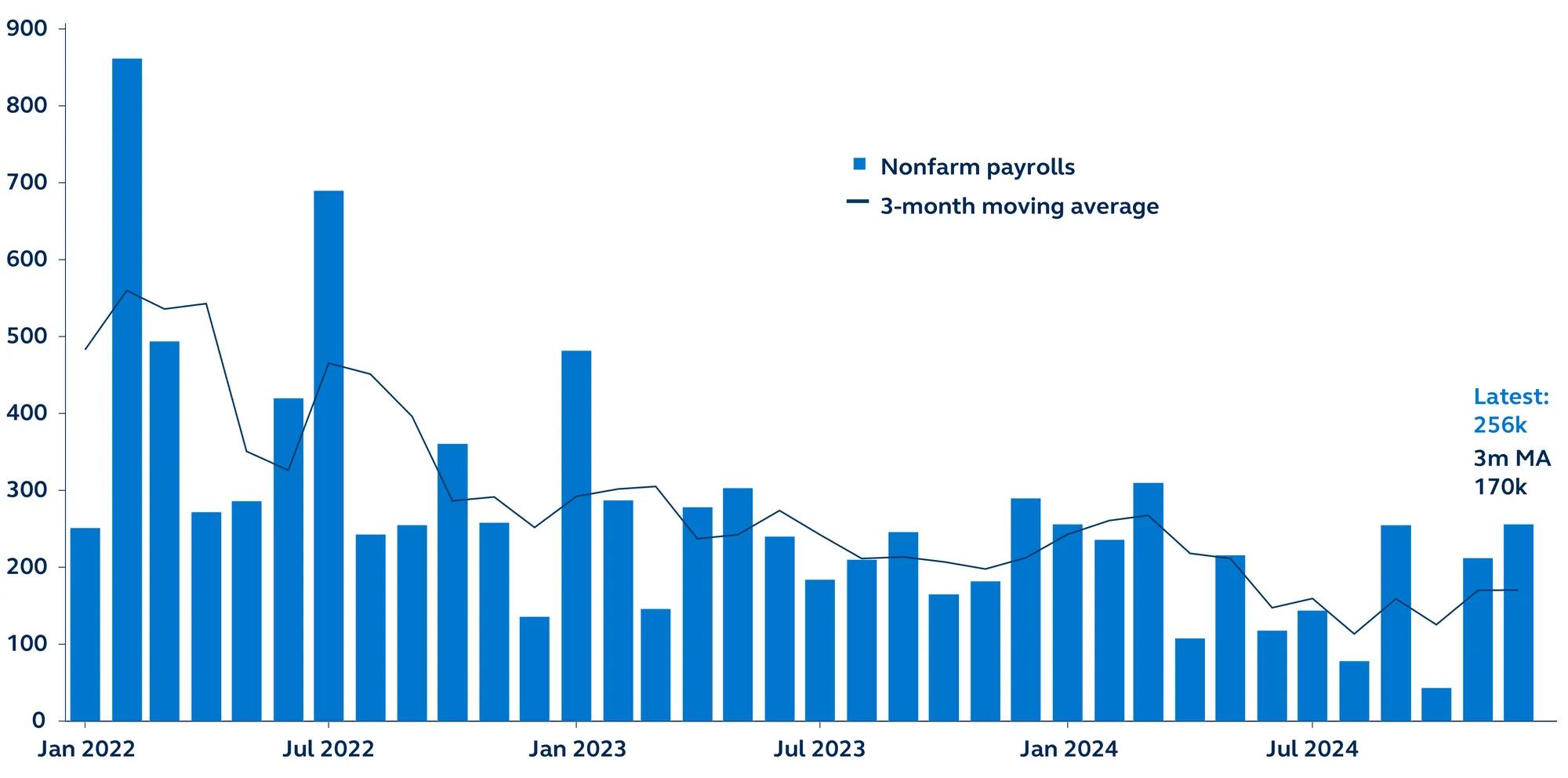

- Total non-farm payrolls increased by a solid 256,000 in December, the most added since March 2024 and well above consensus expectations, which had been calling for 165,000. December’s report was a continuation of the strong gains also seen in November, although it was revised slightly lower to 212,000.

- Overall job growth was broad-based across industries, though remained most pronounced in non-cyclical areas of the economy. Healthcare and government employment has continued to trend up in recent months, adding 46,000 and 33,000 jobs, respectively. Healthcare added an average of 57,000 jobs per month in 2024, the same as its average monthly gain in 2023.

- As for cyclical areas of the economy, retail trade saw a rebound in jobs in the month, following a loss in November. This was likely due to the later than usual Thanksgiving and start of the holiday shopping season that delayed hiring plans. Leisure and hospitality also saw continued employment gains, adding 43,000 jobs in the month, while professional and business services gained 28,000 jobs, the most since May 2024. Meanwhile, manufacturing was among the few sectors that were in the red, as employment declined for the fourth time in five months, removing 13,000 jobs and bringing the total job losses in 2024 to 87,000 workers.

- The unemployment rate unexpectedly declined to 4.1%, helped by a slight tick up in hiring and an unchanged labor supply, with the labor force participation rate remaining at 62.5%. Notably, the duration of unemployment ticked lower to 10.4 weeks in the latest period, from a cycle high of 10.5 weeks in the prior month. Despite this positive development, the labor market remains in an uneasy equilibrium—low layoffs coupled with low hirings—suggesting that there remains risk that only a mild pick up in layoffs is needed to see the unemployment rate rise.

- Average hourly earnings rose by 0.3% in the month, as expected, bringing the annual rate to 3.9%, from 4.0% prior. Recent earnings growth has so far remained solid, with the three-month annualized rise in wages staying above the 12-month average of 4.0% at 4.1%.