The April CPI reading delivered the first (slight) downside inflation surprise since the turn of the year, easing niggling concerns that inflation was starting to trend upwards again. Headline CPI slowed to 0.3% month-on-month, slightly weaker than the 0.4% consensus expectation, marking the first cooling in six months. Core CPI also slowed in April, but was in line with expectations. From a Fed perspective, while today’s inflation report is not sufficiently soft to put a July policy rate cut on the table, it does raise the odds of a September cut.

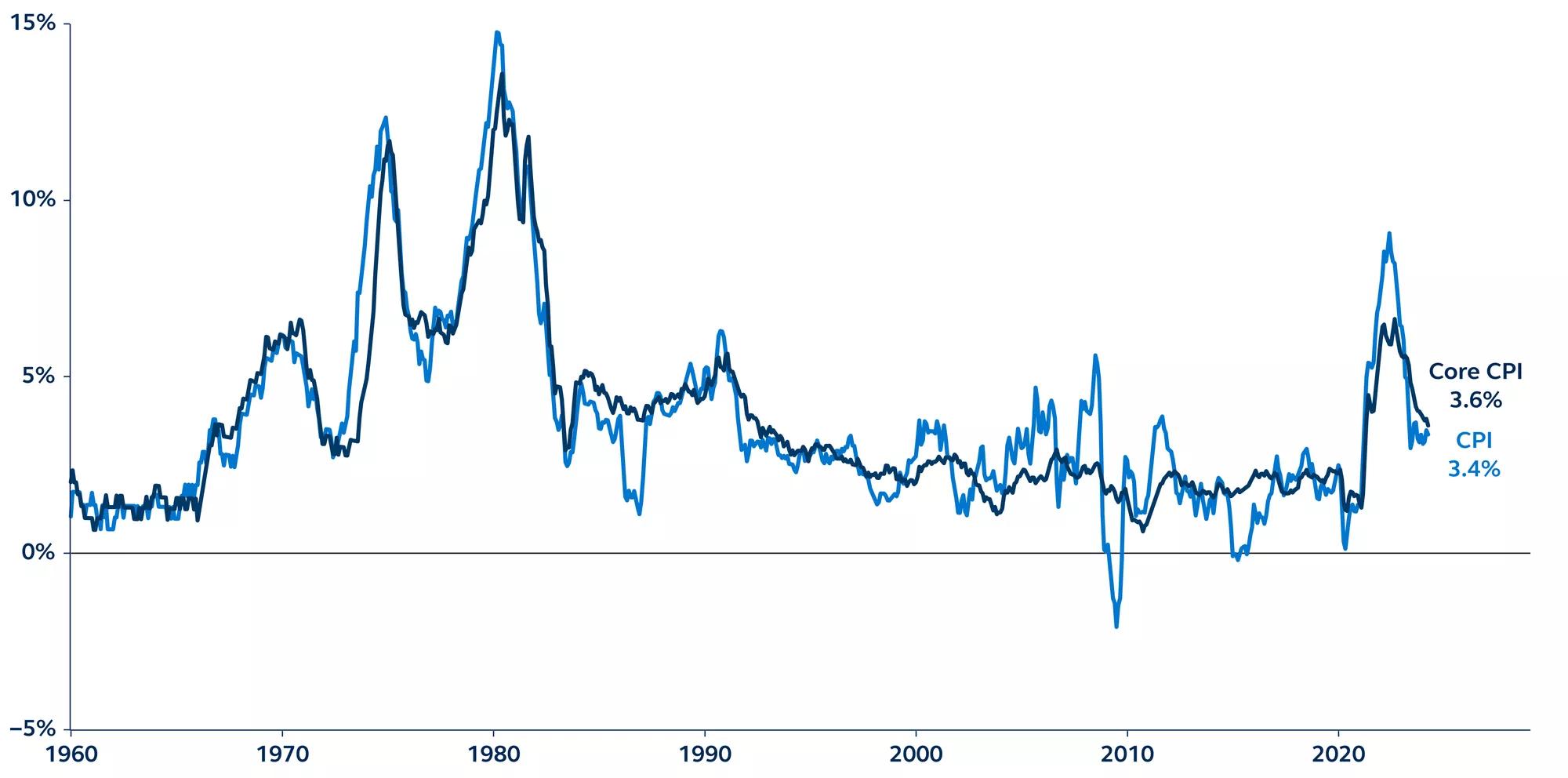

Consumer Price Index

Year-over-year % change, 1960–present

Report details

- Monthly headline inflation slowed from 0.4% in March to 0.3% in April, slightly below consensus expectations for another 0.4% increase. Annual headline inflation eased to 3.4%. After three months sitting at 0.4%, monthly core inflation also eased to 0.3%, although this was in line consensus expectations. Annual core inflation has now eased to 3.6%, the lowest level since April 2021.

- Headline inflation was below expectations due to a downside surprise in food inflation.

- Core goods inflation fell 0.1% in April, driven by lower new and used car prices. By contrast, core services inflation rose 0.4% in April, with car insurance a significant positive contributor —annual prices are rising at the fastest pace since 1976.

- Shelter inflation continued to defy expectations for a decline. Owners’ equivalent rents, the largest component of shelter inflation, remained stuck at 0.4% in April, the same as it’s been for the past few months. The Fed continues to expect it to trend lower but, as Chair Powell noted yesterday, the lags between newly signed leases and the shelter costs in the CPI report have been longer than expected.

- The Fed’s favored supercore inflation measure (core services ex-housing inflation) rose 0.4% in April, down from 0.7% last month and the smallest increase since December of last year.

Policy outlook

Unsurprisingly, today’s report is being well received by the market. Inflation is still too high to make a July policy rate cut a realistic prospect, but markets are certainly relieved that today’s number has reduced the tail risk of another hike. April retail sales were also reported today and came in weaker than expected, adding to the picture of cooling economic momentum. Financial markets are now putting strong odds on the first Fed cut arriving in September—in line with our own expectations.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information in the article should not be construed as investment advice or a recommendation for the purchase or sale of any security. The general information it contains does not take account of any investor’s investment objectives, particular needs, or financial situation.

3581932