After an impressive market rally that saw the S&P 500 rise 64.1% in just 27 months, the market recently retraced approximately 10% of its gains from its peak amid increased concern about the economic outlook. This comes as valuations remain elevated, even after the latest sell-off.

Yet, whether the rally can reassert itself and deliver positive equity returns going forward will likely depend on whether earnings growth can deliver. On the positive, investors should be reassured that today’s macroeconomic environment does not resemble past market peaks.

Indeed, despite the recent softness in sentiment data and concerns about broadening cracks within the labor market, a recession remains unlikely. Not only are underlying household and corporate balance sheets in strong shape, suggesting resiliency against policy headwinds, but Federal Reserve policy easing in the second half of the year, coupled with the introduction of some of the more growth-friendly fiscal policies of the Trump Administration, such as deregulation and tax cuts, could provide an important boost to growth.

What are the typical drivers of a market rally?

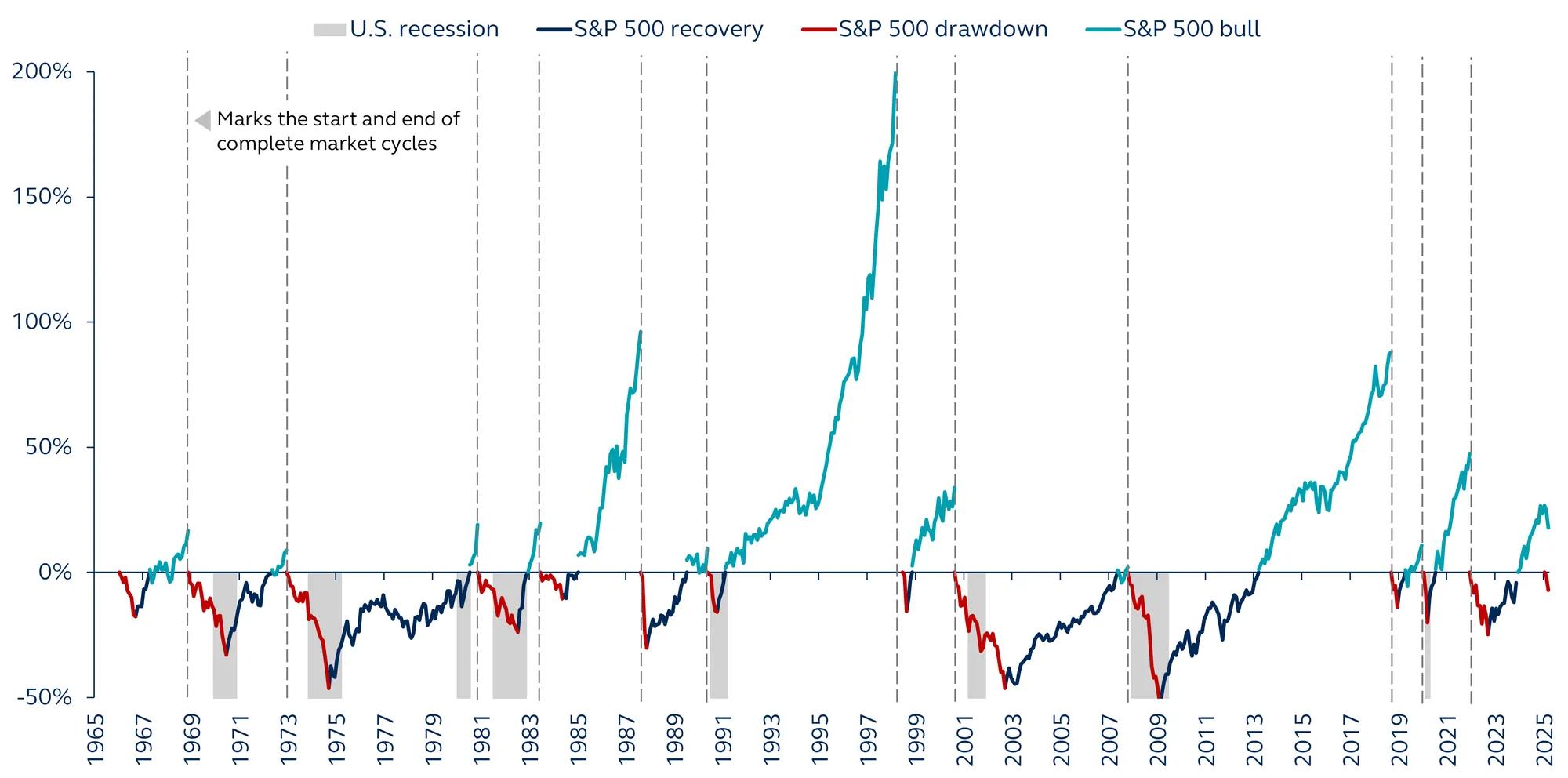

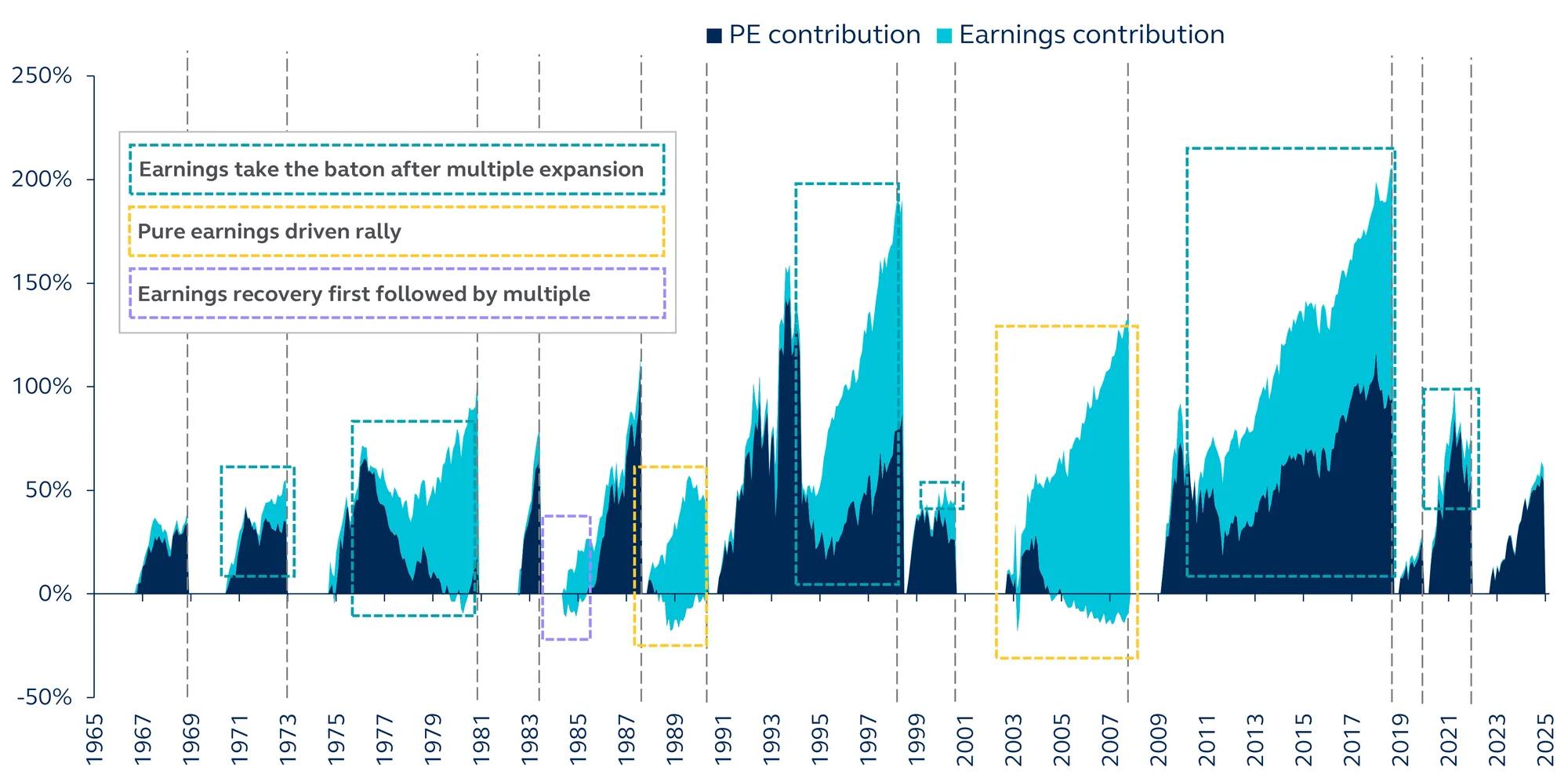

Typically, in shorter market cycles, the market rally is driven by either valuation expansion or earnings growth, not both. These cycles have historically seen the market rally only last 29 months on average versus 46 months on average across all bull markets. In these cases, the size of the market rally also appears limited, typically only increasing 55% on average compared to the average bull market since 1965, where markets rally by 107%.

S&P 500 market regime

1965–present

By contrast, in a longer or more “normal” market cycle, valuations tend to expand after prices trough as positive investor sentiment emerges. This is often followed by earnings growth as hope turns into reality, providing the next catalyst for the markets to extend their rally.

While history does not guarantee future performance, it does suggest that if earnings growth can deliver going forward, markets may deliver further upside.

Return contribution from P/E & earnings

1965–present

The current environment

The latest market cycle began in September 2022, after the market declined by 25% following the Federal Reserve’s hawkish pivot. With the S&P 500 gaining 61% between the trough and end-2024, a decomposition of those returns shows that the bulk of the rally was driven by valuation expansion, with price-to-earnings (PE) ratios expanding 54%, while earnings only grew 7%.

As optimism fades amid elevated policy uncertainty, increasingly adding downside price pressures, lessons from historical cycles suggest that earnings growth will need to take the baton from valuation expansion if the rally can reassert itself.

Rolling 12-month annual earnings growth for the S&P 500, after peaking in April 2022, saw a steady decline and appeared to have bottomed out at -1.2% in January 2024. Furthermore, the limited earnings growth through those two years was concentrated among tech-related industries, while cyclical industries lagged.

Looking ahead, for earnings to grow a solid 10.2% this year as consensus expects and help revive bullish sentiment, investors will likely need to either see a repeat of last year, which saw continued upward revisions in tech earnings compensate for downward revisions in other industries, or earnings growth of other industries finally materialize.

While the continued contribution from secular forces such as innovation and technology should continue to support industries that have outperformed since 2022, the second outcome appears more likely. Indeed, a broadening out of earnings growth is already taking place. Earnings growth has seen solid upward revisions in the last three months, a notable divergence compared to 12 months ago, where revisions were either flat or lower. Upward revisions to tech earnings would also provide a welcome boost to the earnings picture but may not be necessary if the broadening out persists.

This scenario is possible despite the recent softness in sentiment data and increased concerns about broadening cracks within the labor market. Underlying household and corporate balance sheets remain strong, with the latter having ample buffers in the event of stress, given high liquidity, low leverage, and still elevated profit margins. As a result, tailwinds to the earnings outlook remain, and a recession remains unlikely, provided the Fed can pivot to an easier policy stance in the back half of the year. Indeed, the Fed would likely resume its easing cycle if price pressures showed continuing signs of receding. Additional tailwinds may also emerge once other portions of the administration policy agenda are introduced later this year, including a broad deregulatory push and tax cuts, which are likely to support capex and growth. In addition, the continued contribution of secular forces from innovation and technology should continue to support growth in 2025.

Emerging downside risks

Even if earnings growth takes the baton to revive the market rally, valuations need to remain stable. Here, policy poses both upside and downside risks.

Elevated macro uncertainty or renewed inflationary pressures may cause valuations to shrink further, potentially offsetting the tailwind from growing earnings. The experience in the late 1970s suggests that despite robust earnings growth that followed the valuation-led market rally that began in 1974, rising interest rates amid fears of inflation resulted in PEs contracting. This weighed on market returns, with the S&P only gaining 8% per annum between August 1976 and November 1980 despite earnings growing 15%.

On the other hand, there could also be a narrow path to a revival of animal spirits in the market that provides a floor to valuations. An improvement in the fiscal environment leading to either lower deficits, growth-inducing tax cuts, or a stabilization in the global trade environment, coupled with inflation continuing to normalize, may provide a supportive backdrop for Treasury yields, which are likely to move lower in such a scenario. Valuations in this environment would likely remain stable or even march higher.

Considerations for investors

While today’s macro environment doesn’t resemble past market peaks, questions linger about whether bullish sentiment can reassert itself and whether further upside this year is possible, especially given still tight valuations and rising uncertainty from seemingly haphazard policy decisions.

Despite the recent blip, history suggests that long market cycles are possible, especially ones that are initially valuation-driven and then followed by earnings growth. Indeed, markets may yet eke out positive gains this year, especially if earnings growth couples with a broadening in earnings breadth beyond technology and into more cyclical industries.

The main risk to the outlook, however, arises from policy choices. This is particularly true if heightened macroeconomic uncertainty—stemming from fiscal missteps, an escalation of the trade war, or a resurgence of inflation—leads to a decrease in valuations before earnings can effectively take over.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Risk considerations

Investing involves risk, including possible loss of principal. Past Performance does not guarantee future return. All financial investments involve an element of risk. Asset allocation and diversification do not ensure a profit or protect against a loss.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. Information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided.

This material may contain ‘forward‐looking’ information that is not purely historical in nature and may include, among other things, projections, and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This document is intended for use in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (Ireland) Limited, 70 Sir John Rogerson’s Quay, Dublin 2, D02 R296, Ireland. Principal Global Investors (Ireland) Limited is regulated by the Central Bank of Ireland. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (Ireland) Limited (“PGII”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGII, PGIE or PGII may delegate management authority to affiliates that are not authorized and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID).

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority (“FCA”).

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- United Arab Emirates by Principal Investor Management (DIFC) Limited, an entity registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as an Authorised Firm, in its capacity as distributor / promoter of the products and services of Principal Asset Management. This document is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No.199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under Corporations Act 2001.

- Hong Kong SAR (China) by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission.

- Other APAC Countries/Jurisdictions. This material is issued for Institutional Investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Global Investors, LLC (PGI) is registered with the U.S. Commodity Futures Trading Commission (CFTC) as a commodity trading advisor (CTA), a commodity pool operator (CPO) and is a member of the National Futures Association (NFA). PGI advises qualified eligible persons (QEPs) under CFTC Regulation 4.7.

Principal Asset Management℠ is a trade name of Principal Global Investors, LLC.

Insurance products and plan administrative services provided through Principal Life Insurance Co. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Principal Securities, Inc., 800‐547‐7754, Member SIPC and/or independent broker/dealers. Principal Life, Principal Funds Distributor, Inc., and Principal Securities are members of the Principal Financial Group®, Des Moines, IA 50392.

© 2025 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

4330283