It can be easy for investors to let their political persuasions impact their long-term financial judgment. However, allowing the outcomes of elections, particularly ones as polarized as what investors are facing this fall, to trigger an adjustment to portfolio allocations or even a withdrawal from markets entirely, has historically proven to be a less than ideal decision.

The stock market and presidencies

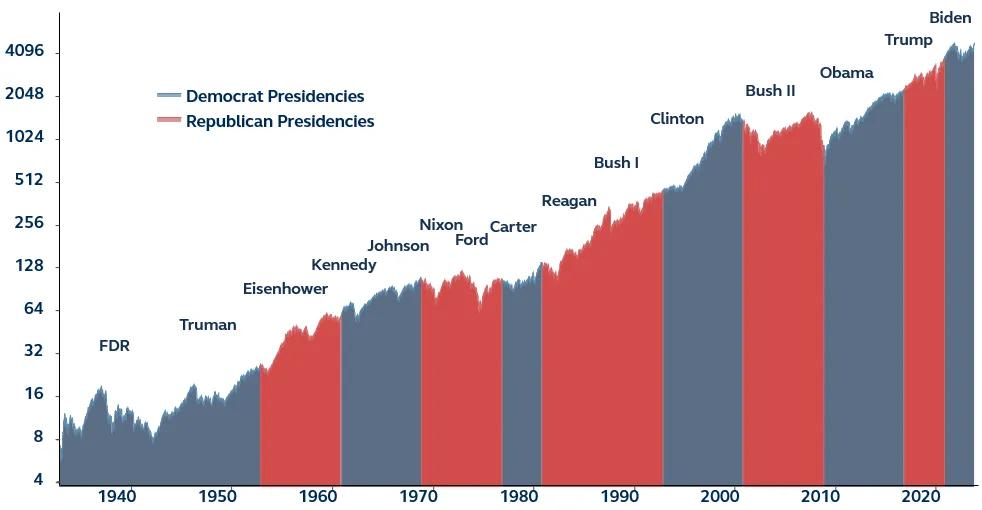

S&P 500 price returns on a log scale with presidents and their parties highlighted since 1933

Don’t let political belief cloud long-term plan

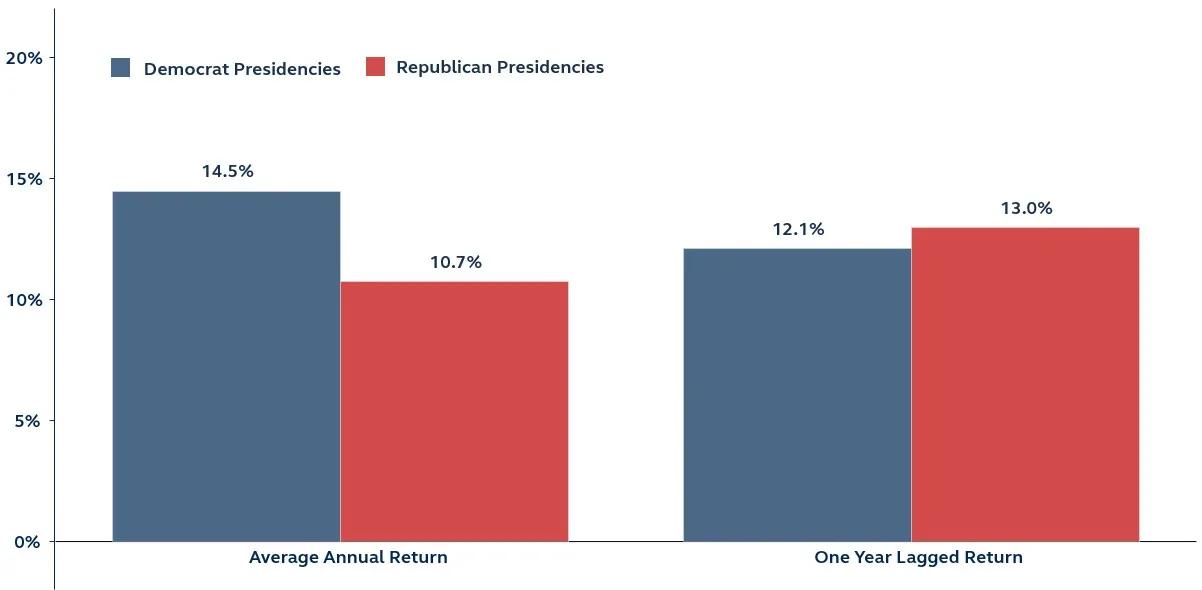

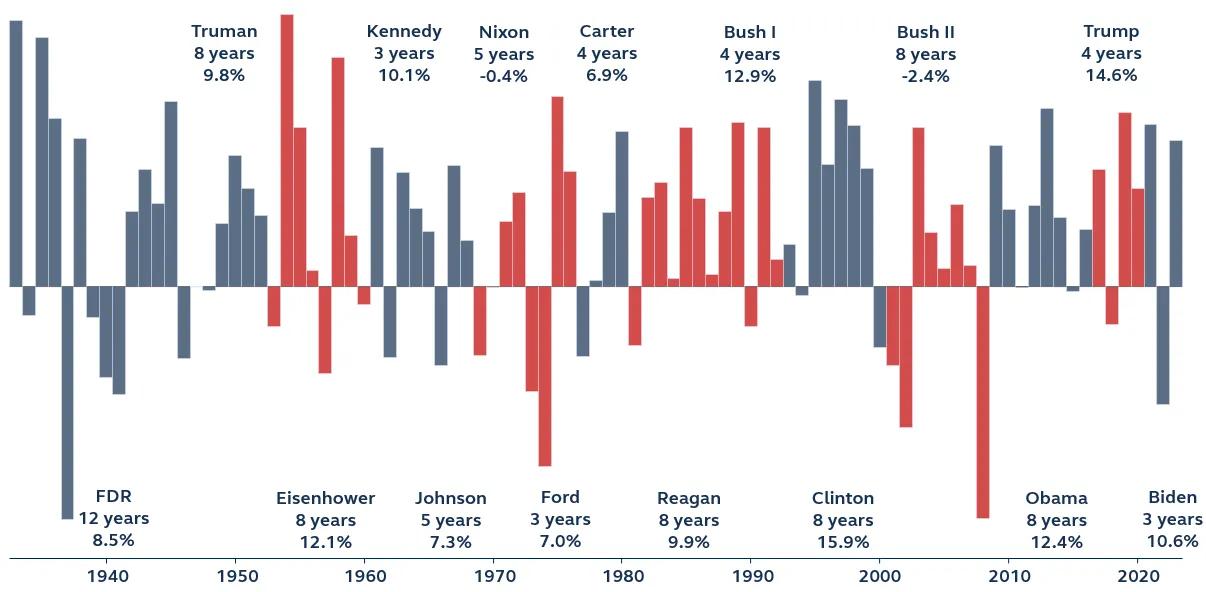

Consider: U.S. stocks have almost always risen by the end of a president's term, regardless of their party affiliation, with the S&P 500 averaging double-digit gains since 1933 whether Democrats or Republicans occupy the White House. Additionally, historical data shows that market returns are generally positive during both election and non-election years. While the past doesn't guarantee future outcomes, and annual returns can be unpredictable, exiting the market due to an election result or simply because an election is happening is not a historically supported decision.

Presidential elections and stocks

S&P 500 total returns by presidential party, returns during presidency and lagged one year since 1933

Furthermore, focusing too much on who was in the White House would have resulted in poor investment decisions over history. For example, from 2008 through 2020, the S&P 500 generated a total return of 236% across the Obama and Trump administrations. This occurred despite the vast perceived differences between the parties and the increasing polarization of Washington politics. It also occurred despite many budget battles, fiscal cliffs, debt ceiling crises, and U.S. credit rating downgrades, not to mention the global financial crisis, the pandemic, and more.

Focus on the fundamentals, not election-related headlines

This is why for most long-term investors, it makes more sense to focus on fundamentals rather than day-to-day election coverage. On a short-term basis, election headlines have the power to move markets and create stock market volatility. However, these moves are often quickly eclipsed by the long-term gains created by market and business cycles. These cycles are influenced by many factors, from economic growth to corporate profits, monetary policy to valuations, technological revolutions to globalization, and not just the occupant of the Oval Office. The historically strong returns since 2008, with the market reaching all-time highs, are more attributable to these underlying economic trends than to the administrations of Obama, Trump, or Biden.

U.S. Presidents, their terms, and S&P 500 returns

S&P 500 price returns on a log scale with presidents and their parties highlighted since 1933

This phenomenon, where markets perform both positively and negatively, regardless of political narratives about either party’s strengths or weaknesses, is best exemplified by the 1990s and early 2000s. Bill Clinton's two terms, from January 1993 – January 2001, coincided with the information technology boom, while the dot-com bust began as George W. Bush took office. Additionally, the 2008 financial crisis occurred at the end of Bush's second term, encompassing both significant market crashes within his presidency. So, while policies played a role, technological and financial innovations were the primary drivers of the booms and busts – and attributing the market behavior solely to Clinton’s and Bush’s presidencies would be an overstatement. The sitting president simply often receives too much blame and credit for economic conditions.

Investment implications

Ultimately, the cyclical and secular economic factors tend to influence the market more significantly than politics. Investors who allowed their political opinions to overrule their investing discipline may have missed out on above-average returns during political administrations they didn't like. Maintaining an active, long-term approach is advisable even for those concerned about political outcomes in Washington D.C.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Risk Considerations

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Inflation and other economic cycles and conditions are difficult to predict and there Is no guarantee that any inflation mitigation strategy will be successful.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account.

All figures shown in this document are in U.S. dollars unless otherwise noted.

This material may contain ‘forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is issued in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (Ireland) Limited, 70 Sir John Rogerson’s Quay, Dublin 2, D02 R296, Ireland. Principal Global Investors (Ireland) Limited is regulated by the Central Bank of Ireland. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (Ireland) Limited (“PGII”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGII, PGIE or PGII may delegate management authority to affiliates that are not authorised and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID).

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority (“FCA”).

- United Arab Emirates by Principal Global Investors LLC, a branch registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as a representative office and is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under Corporations Act 2001.

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- Hong Kong SAR (China) by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission.

- Other APAC Countries/Jurisdictions, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Funds are distributed by Principal Funds Distributor, Inc.

© 2024 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

Principal Asset Management℠ is a trade name of Principal Global Investors, LLC.

3732112