After a turbulent and unexpected 2023, there is widespread concern that commercial real estate (CRE) will face an additional challenge in 2024: a wall of maturities that threatens to undermine the asset class further. Yet, while the ability to service existing debt maturities appears challenging and is a potential source of weaker pricing trends in 2024, this vulnerability is primarily focused on the office sector. Other sectors remain well-funded and will be supported by a constructive economic backdrop, suggesting that the market is over-pricing the risks and, in turn, setting up an opportunity for investors to take advantage of attractive valuations in CRE.

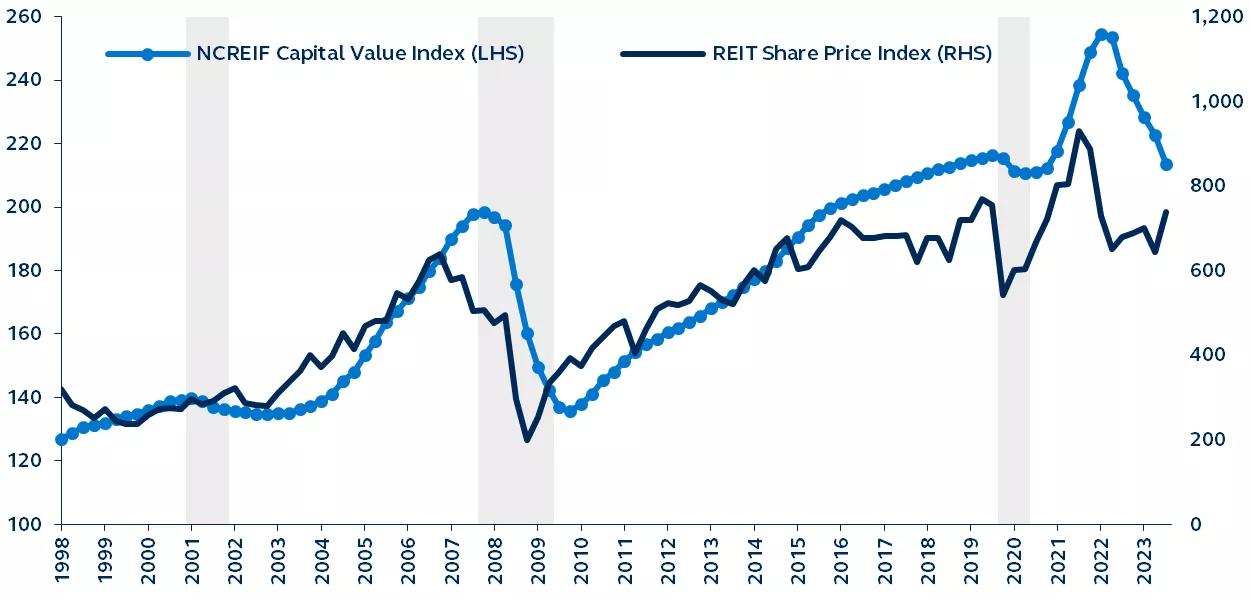

U.S. equity REIT share price and NCREIF (NPI) capital value indices

Rebased to 100 at 1977Q4, recessions are shaded

The fallout from the 2023 regional banking crisis

2023 was the worst year for CRE investors since 2009. On the heels of the Fed’s historic tightening cycle that began in March of 2022 and after the failure of two major regional banks—Silicon Valley Bank (SVB) and Signature Bank—debt capital from depository institutions, which accounts for 38% of all outstanding CRE loans, was effectively removed from the market.

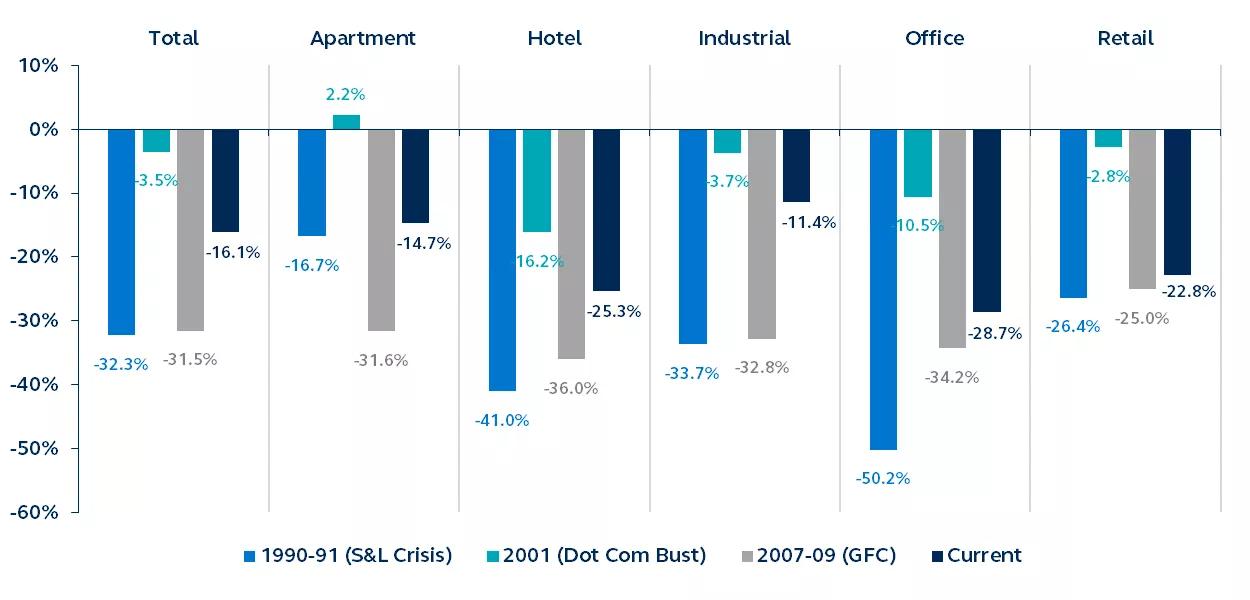

Transaction markets were effectively shuttered in the first half of 2023, ultimately resulting in total property sales declining by 65% relative to 2022. While the lack of debt capital originating from banks reduced liquidity and contributed to capital value declines across all property sectors (the NCREIF Property Index, the NPI, saw a decline of 12.5%), the impact on office market values was exceptionally destructive, declining 28.7%, since Q2 2020.

NPI appreciation: Peak to trough declines

By sector across various time periods

Valuations, friend or foe?

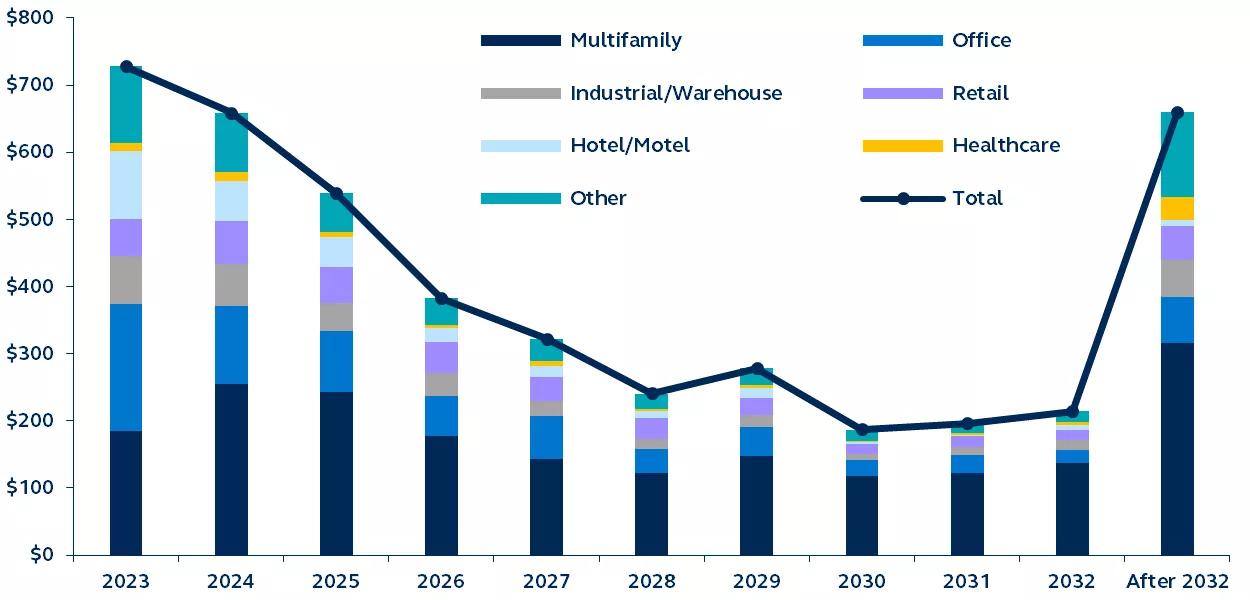

After such a torrid 2023, the CRE market is deeply discounted. But while such attractive valuations would typically present a compelling opportunity, CRE’s challenges are now compounded by fears of elevated refinancing risk. Of the $4.4 trillion outstanding CRE debt, roughly $1.2 trillion is scheduled to mature by 2025.

Furthermore, with debt markets remaining pressured by stringent underwriting requirements and amid higher borrowing costs, this risk was explicitly highlighted by the Federal Reserve (Fed) in its December 2023 meeting minutes, commenting that “a significant share of properties would need to be refinanced in 2024 against a backdrop of higher interest rates, continued weakness in the office sector, and balance sheet pressures faced by some lenders.”

Yet, while the maturity wall is undoubtedly significant, refinancing risk should be relatively well contained for three reasons.

- Policy backstops: Although refinancing risk in the CRE market tends to arise during periods of illiquidity and stress in market fundamentals, worst-case scenarios have seldom come to pass. During the worst financial crises of the past 40 years—namely, the Savings and Loans Crisis (1980- 1989) and the Great Financial Crisis (2007-2010)—the federal government backstopped distress in the CRE and financial markets via the Resolution Trust Company and the Troubled Asset Relief Program. Given the potential contagion impact of CRE, policymakers will be keen to avoid additional stress on the financial system. They would be likely quick to head off any possible run on banks as they did following the regional bank failures in 2023.

- Economic backdrop: The CRE sector is not currently burdened by a financial crisis or recession, and tenant demand for space remains healthy, providing sustained income returns to investors.

- Sectoral make-up: In 2024 alone, $658 billion of CRE debt is scheduled to mature. Yet more than half of this sum is in the apartment ($225 billion) and office sectors ($117 billion). The apartment sector currently poses minimal risks. Not only is it experiencing healthy market demand, but this sector is unique in that it directly benefits from government-sponsored entities (i.e., Fannie Mae and Freddie Mac) with the express mission of providing liquidity to the residential market. Consequently, it has been the one sector in which debt capital has been consistently available since 2022, and this is expected to persist.

The office sector, by contrast, is already facing several meaningful challenges, such as weak demand fundamentals driven by poor workplace attendance post-COVID. The knock-on effects presage weak flows of debt capital available to refinance maturities. For their part, banks are already overexposed to the sector, and investors remain concerned about the long-term viability of the office market. Fortunately, weaknesses should remain confined to the office sector as others are better positioned from a fundamental and liquidity standpoint to remain attractive to lenders and investors. Indeed, growing investor interest in emerging growth sectors such as data centers, infrastructure, and single-family rentals has meant that the office sector now accounts for just 6% of global publicly listed real estate investment trusts (REITs).

Although the office sector accounts for a greater percentage of private equity real estate, its share among private equity real estate investors is a relatively small 17.8%, having fallen from 34.6% just five years ago1. As such, permitted other real estate sectors show limited signs of distress, office sector weakness should remain confined.

Total maturities by property sector

$billions

Attractive valuations amid a soft landing

Investing in the real estate sector in 2024 is not devoid of risk, however, the risk associated with the refinancing wall is likely less pertinent than the markets and the Fed have suggested. Furthermore, the troubles faced by the office sector are not a proxy for the broader real estate sector. In fact, this disconnect can create opportunities for investors who can benefit when the overly pessimistic sentiment shifts.

Certainly, with extremely attractive valuations compared to prior years, the main determinant of CRE performance in 2024 will be economic performance and the durability of economic expansion. If the Fed can pivot to an easing cycle against the backdrop of ample liquidity and positive economic growth, 2024 could provide a transition point for the CRE market.

Refinancing risk in 2024 poses minimal threat to commercial real estate, given its sector- and asset-specific nature. While the office sector may remain a vulnerable area, it is unlikely to hinder what is anticipated to be a transformative year for the real estate asset class.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Risk Considerations

Investing involves risk, including possible loss of Principal. Past Performance does not guarantee future return. All financial investments involve an element of risk. Therefore, the value of the investment and the income from it will vary and the initial investment amount cannot be guaranteed. Potential investors should be aware of the risks inherent to owning and investing in real estate, including value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk. All these risks can lead to a decline in the value of the real estate, a decline in the income produced by the real estate and declines in the value or total loss in value of securities derived from investments in real estate. Commercial mortgages are subject to the basic risk of lending and direct ownership of commercial real estate mortgages - borrower default on the loan and declines in the value of the real estate collateral. Defaults can be complicated by borrower bankruptcy and other litigation including the costs and expenses associated with foreclosure which can decrease an investor’s return.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account.

Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided.

All figures shown in this document are in U.S. dollars unless otherwise noted.

This material may contain ‘forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. This document is issued in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (Ireland) Limited, 70 Sir John Rogerson’s Quay, Dublin 2, D02 R296, Ireland. Principal Global Investors (Ireland) Limited is regulated by the Central Bank of Ireland. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (Ireland) Limited (“PGII”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGII, PGIE or PGII may delegate management authority to affiliates that are not authorised and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID).

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority (“FCA”).

- United Arab Emirates by Principal Global Investors LLC, a branch registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as a representative office and is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under Corporations Act 2001.

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- Hong Kong SAR (China) by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission.

- Other APAC Countries/Jurisdictions, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Funds are distributed by Principal Funds Distributor, Inc.

© 2024 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset Management℠ is a trade name of Principal Global Investors, LLC. Principal Real Estate is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.

3354153