Historically, the best performing investment vintages have often followed periods of distress and volatility. Commercial real estate has experienced a significant downturn since the Federal Reserve (Fed) started raising interest rates in the spring of 2022. However, in our view, the stage is now set for real estate credit to generate attractive income returns with favorable risk tailwinds.

At-a-glance

We believe the environment is favorable for real estate credit to generate attractive income returns with supportive risk tailwinds. Here we explain three reasons why:

- Banks’ pullback on direct real estate lending creates opportunities for private lenders.

- Real estate credit is well-positioned to navigate an economic slowdown.

- Opportunities lie in newly assembled portfolios; legacy vehicles are burdened with risks driven by valuation declines in underlying collateral.

Introduction: Downturn leads to opportunity

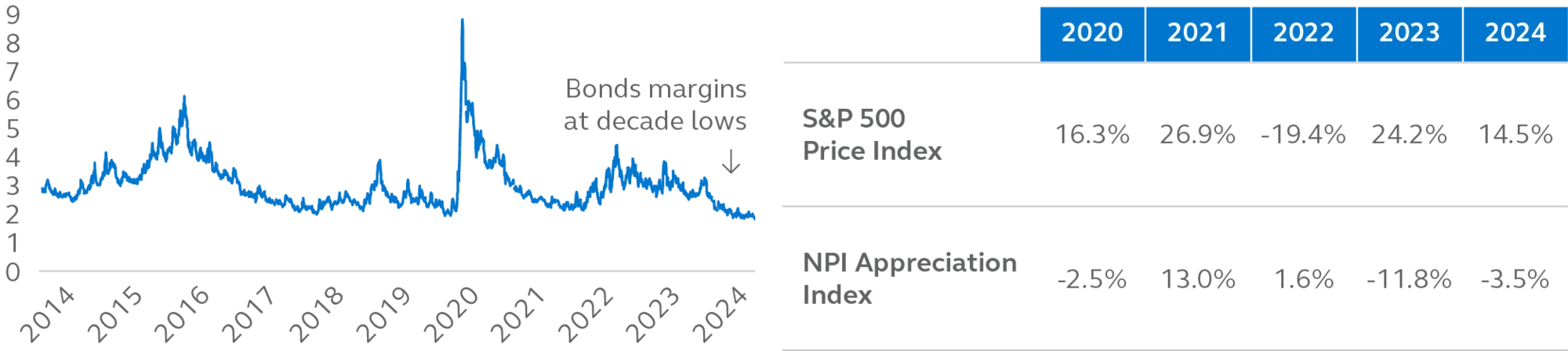

Over the past three years, performance in the commercial real estate (CRE) sector has been quite different than in other sectors. The NPI Appreciation Index, which tracks the performance of commercial real estate, peaked in the second quarter of 2022 and has fallen roughly 19% through the second quarter of 2024. (CRE performance may have been even worse than that since the NPI is an appraisal-based index and data can lag. Real time trades indicated declines may be 30% +/- from the peak to date.)

In contrast, the S&P 500 is trading at near record highs—up approximately 53% as of 30 June 2024, from the third quarter of 2022, fueled in large part by technology companies. Even after a week of turmoil in early August, fixed income spreads are re-approaching decade lows—indicating a high degree of investor confidence in the Fed engineering a soft landing.

EXHIBIT 1: Equities and fixed income have had a significant run-up in valuation, while CRE is bottoming

Banks’ pullback on direct real estate lending creates opportunities for private lenders

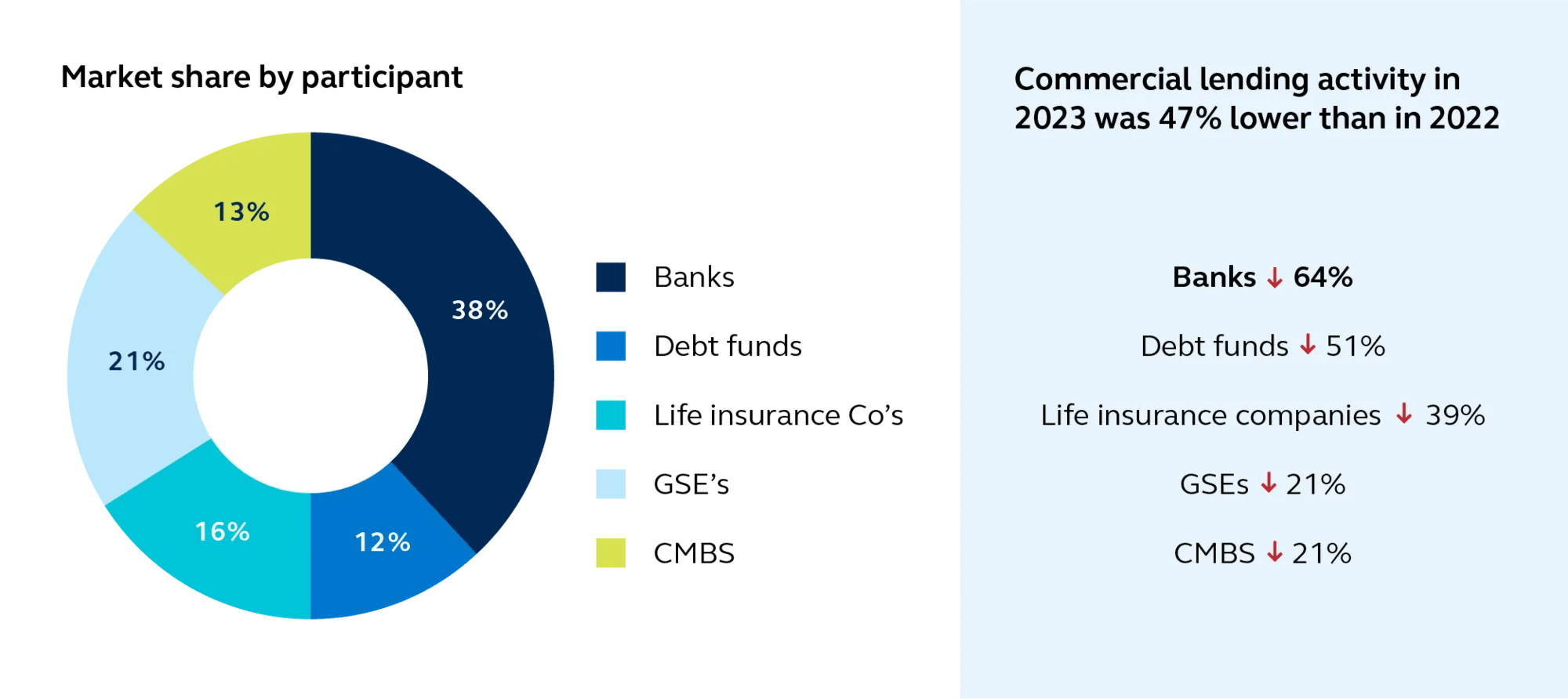

Banks are regularly in the news reporting losses from their commercial real estate loans. These are, of course, legacy portfolios, and banks are likely going to report losses on their CRE loans for several years to come. The process of working out problem loans, especially office exposures, takes time. Loans will be restructured or foreclosed, and in some cases, both. Eventually, banks will realize the losses, and values and market rents will clear.

While banks work through this stress, they have dramatically pulled back on direct real estate lending. At the same time, banks are also looking to finance senior mortgages as regulators provide better capital treatment for this conservative risk profile. The stage is set for private lenders to increase market share, similar to the gains made post the global financial crisis.

EXHIBIT 2: Banks continue to pull back on direct real estate lending

Real estate credit is well-positioned to navigate any future economic slowdown

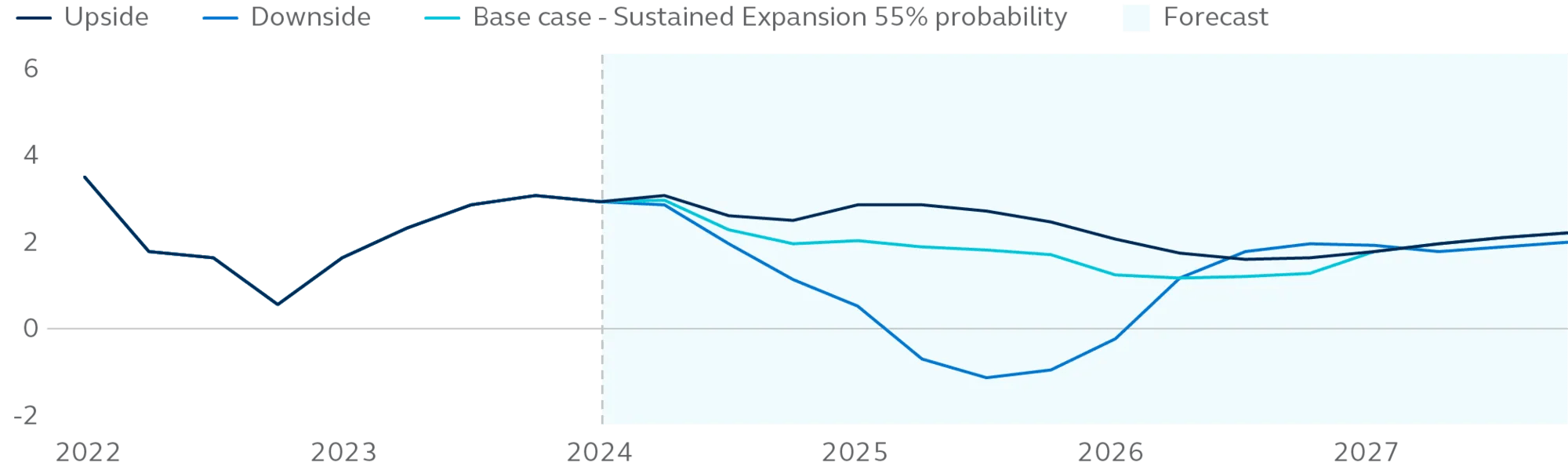

A recent industry survey indicated market participants believe average appreciation for apartments and industrial properties will be in the low single digits for the 2024-2028 period. In contrast to equity investments, real estate credit returns primarily consist of loan payments and thus are almost all in the form of income. So, while future value appreciation may be muted, the income focus of real estate credit may help support achieving the targeted returns.

Given the debt profile, real estate credit investors receive the greater protection afforded by being senior to the equity investor in the capital stack—often roughly 25-30% of an asset’s capitalization. On the heels of the recent 20- 30% drop in collateral values, coupled with a fresh 25-30% new equity cushion, we believe real estate credit is wellpositioned to navigate an economic slowdown—even a recession.

EXHIBIT 3: Potential GDP growth scenarios

Legacy vehicles pose challenges; opportunities lie in newly assembled portfolios

On the surface, it may not seem intuitive to allocate capital to a space in which valuations have been under pressure. For legacy real estate credit vehicles, that is true. The valuation of legacy loans can be difficult, making it hard to ensure the accuracy of the net asset values. Furthermore, dealing with liquidity needs in an environment in which the loans are under stress can be quite challenging.

Those challenges are not present in a newly formed investment vehicle comprised of post-inflation loans. More recently assembled portfolios factor in real-time valuations based on today’s higher interest rate environment. Therefore, they enable investors to take advantage of the position of the CRE sector now and the opportunities to come.

Summary: Strong opportunities for diversification with real estate credit

For future asset allocation decisions, there is a strong argument to take some “chips off the table” with respect to U.S. equities and to diversify a portfolio’s debt holdings. The opportunities presented by commercial real estate credit are driven by the distress caused by rate hikes in both the banking sector and broadly across the real estate market. This is not a new phenomenon; real estate credit has historically performed best in the years following a downturn. We believe reset valuations, the strength of current market loan-level metrics, and the quality of the underwriting practices, make for attractive opportunities in real estate credit.

For Public Distribution in the United States. For Institutional, Professional, Qualified, and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Risk Considerations

Investing involves risk, including possible loss of principal. Past Performance does not guarantee future return. Asset allocation and diversification do not ensure a profit or protect against a loss. Potential investors should be aware of the risks inherent to owning and investing in real estate, including value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk. All these risks can lead to a decline in the value of the real estate, a decline in the income produced by the real estate and declines in the value or total loss in value of securities derived from investments in real estate. Private credit involves an investment in non-publicly traded securities which are subject to illiquidity risk. Portfolios that invest in private credit may be leveraged and may engage in speculative investment practices that increase the risk of investment loss. Investments in Private Credit may also be subject to real estate-related risks, which include new regulatory or legislative developments, the attractiveness and location of properties, the financial condition of tenants, potential liability under environmental and other laws, as well as natural disasters and other factors beyond a manager’s control.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account.

Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided. All figures shown in this document are in U.S. dollars unless otherwise noted.

This material may contain ‘forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Integration of sustainability considerations and/or environmental, social and governance (ESG) factors is qualitative and subjective by nature. There is no guarantee that the criteria used, or judgment exercised, will reflect the beliefs or values of any particular investor. There is no assurance that any strategy or integration of sustainability considerations and/or ESG factors will be successful or profitable.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is issued in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (Ireland) Limited, 70 Sir John Rogerson’s Quay, Dublin 2, D02 R296, Ireland. Principal Global Investors (Ireland) Limited is regulated by the Central Bank of Ireland. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (Ireland) Limited (“PGII”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGII, PGIE or PGII may delegate management authority to affiliates that are not authorised and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID).

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority (“FCA”).

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- United Arab Emirates by Principal Global Investors LLC, a branch registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as a representative office and is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under Corporations Act 2001.

- Hong Kong SAR (China) by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission.

- Other APAC Countries/Jurisdictions, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Global Investors, LLC (PGI) is registered with the U.S. Commodity Futures Trading Commission (CFTC) as a commodity trading advisor (CTA), a commodity pool operator (CPO) and is a member of the National Futures Association (NFA). PGI advises qualified eligible persons (QEPs) under CFTC Regulation 4.7.

Principal Funds are distributed by Principal Funds Distributor, Inc.

© 2024 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset Management℠ is a trade name of Principal Global Investors, LLC. Principal Real Estate is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.

MM14090 | 08/2024 | 3744456-122025