An all-weather emerging market debt solution designed to navigate market ups & downs.

4:23 minView video transcript

Why invest in EMD?

As we position for central bank cuts, EMD remains attractive due to its higher income potential, with historically high yields and resilient growth relative to developed markets.

Invest with Principal Finisterre, a top-tier risk manager, to gain access to elevated yields and attractive diversification opportunities in EMD.

Our investment concept

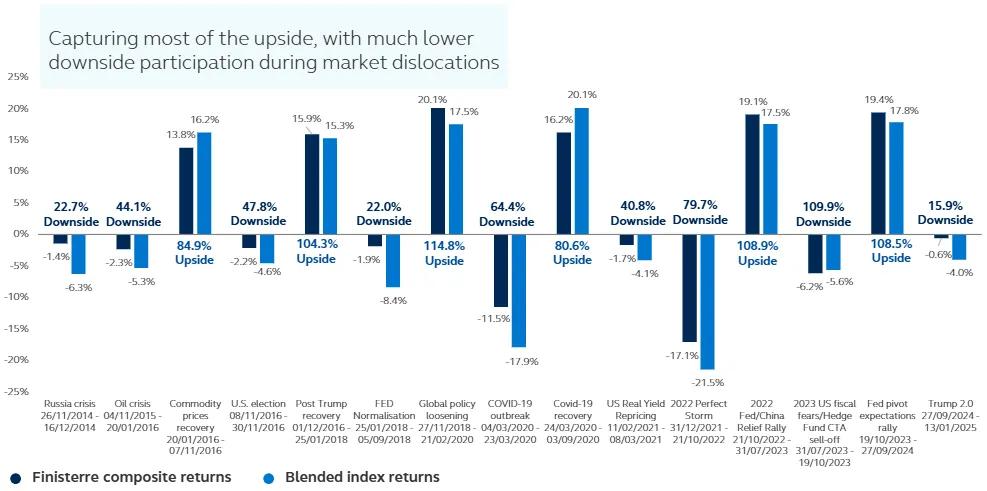

We seek to potentially capture 90%+ of EMD market1 upside for 50% of its volatility and less than 50% of downside.

-

Consistent returns with low volatility

Maximisation of income is a key component of performance, complemented by potential capital gains from tactical allocations and relative value opportunities. -

Designed to be an “all-weather” solution

Assesses the full EMD market cycle and allocates to U.S. dollar, sovereign or corporate credit, local currency bonds, and foreign exchange assets. -

Innovative portfolio construction process

Proprietary scoring system ranks each security as a performance driver (cash, income, alpha, and beta) and monitors allocations based on the market cycle, emphasizing volatility and liquidity. -

Experienced active EMD investment team

Actively invests across the entire EMD universe, continuously monitoring liquidity and hedging to limit capital losses during market stress.

Upside/downside capture

The strategy has been able to deliver on its objective—capturing most of the upside, with much lower downside participation during major EMD market events.

Composite performance: Finisterre’s composite track record (gross of fees) vs. main EMD market indices

Source: Principal Finisterre. Data as of 13 January 2025. Chart reflects gross of fees performance of the Finisterre Emerging Market Total Return Composite. For illustrative purposes only. The Blended Index is the JP Morgan EM Equal Weight Total Return Index which is currently 33.3% CEMBI Broad Diversified, 33.3% EMBI Global Diversified, and 33.3% GBI-EM Global Diversified, gross of withholdings taxes, rebased monthly. The benchmark was changed retroactively on 30 April 2017 back to 1 June 2013. This change is due to the fact that the current benchmark more accurately reflects the investment strategies of the composite. No leverage cost assumed. Additional information concerning this is available on request. Past performance is not a reliable indicator of future performance.

About Principal Finisterre

-

A specialist EMD investment manager, founded in London in 2002.

-

As of 31 March 2025, the team manages US$4.88 billion of assets.

-

Offering the strength of a dedicated EMD solution provider, backed by a global asset management leader.

-

The team has an average market experience of 14 years with deep experience managing portfolios through market dislocations.

Damien Buchet, CFA

Chief Investment Officer

33 years investment experience

Christopher Watson, CFA

Senior Portfolio Manager

26 years investment experience

A rated - Citywire Fund Manager Ratings

Explore more from Principal Finisterre

1 For the purpose of the above statement, we define the market as per our composite performance comparator which is currently 33.3% CEMBI (USD EM Corporates) / 33.3% EMBIG (USD EM Sovereigns) / 33.3% GBI-EM (EM local currency bonds).

For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in Permitted Jurisdictions as defined by local laws and regulations.

Unless otherwise noted, the information in this document has been derived from sources believed to be accurate at the time of production. Information derived from sources other than Principal Global Investors or its affiliates is believed to be reliable; however, we do not independently verify or guarantee its accuracy or validity. The information in this document contains general information only on investment matters. It does not take account of any investor’s investment objectives, particular needs or financial situation and should not be construed as specific investment advice, an opinion or recommendation or be relied on in any way as a guarantee, promise, forecast or guarantee of future events regarding a particular investment or the markets in general. All expressions of opinion and predictions in this document are subject to change without notice. All figures shown in this document are in U.S. dollars unless otherwise noted.

Past performance does not guarantee future results.

Fixed‐income investment options are subject to interest rate risk, and their value will decline as interest rates rise. International and global investing involves greater risks such as currency fluctuations, political/social instability, and differing accounting standards. Risk is magnified in emerging markets, which may lack established legal, political, business, or social structures to support securities markets. Emerging market debt may be subject to heightened default and liquidity risk. Risk management techniques seek to mitigate or reduce risk but cannot remove it.

Principal Finisterre is an investment team within Principal Global Investors.

Source & Copyright: CITYWIRE. Portfolio managers are A rated by Citywire for 3 year risk-adjusted performance for the period 28 February 2022 - 28 February 2025. Citywire’s exclusive methodology ranks fund managers based on their individual track records across all funds they manage globally.

4557230-062026