Heading into 2025, U.S. exceptionalism remained a dominant theme. But tech sector struggles, downward revisions to U.S. economic growth forecasts, and Germany’s landmark infrastructure and defense spending package have left investors questioning that assumption. Still, there are reasons to believe U.S. exceptionalism will continue, given skepticism over the EU’s ability to replicate Germany’s fiscal stimulus—and concerns that Europe’s heavy regulation continues to stifle growth. For now, it seems the U.S. will ultimately regain its top position.

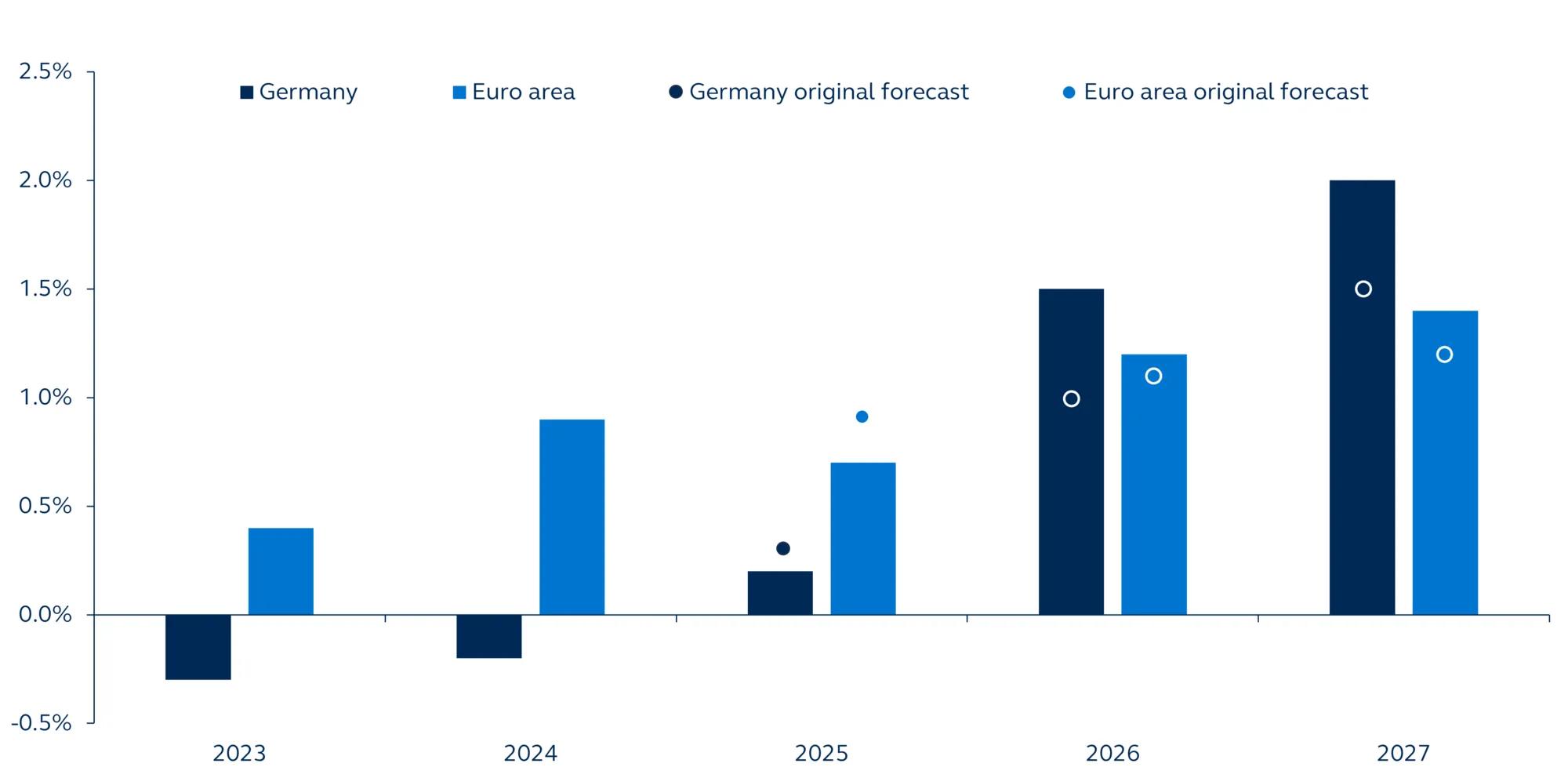

Growth forecast revisions

2023-2027

At the beginning of the year, U.S. exceptionalism was anticipated to continue. However, recent developments have challenged this notion. The U.S. tech sector, a primary driver of American market performance, faces scrutiny over high valuations and earnings expectations. Growth expectations for the U.S. economy have been revised downward in response to rising policy uncertainty, and policy proposals that have proven to be more severe than widely expected.

In contrast, Germany has enacted a significant spending package, unlocking nearly a trillion euros for defense and infrastructure, signaling the most substantial shift in Germany's fiscal policy since reunification. This expansion, coupled with European equities outperforming the U.S. YTD, has led to questions about U.S. dominance.

Forecasts suggest that while tariffs will subdue German growth this year, there will be a meaningful strengthening in the coming years once the fiscal impulse kicks in. Notably, as it makes up about a third of Euro area GDP, Germany’s expansion should lift broader European growth, although as other EU countries lack the same fiscal capacity they are unlikely to enjoy fiscal stimulus boosts themselves.

However, despite this positive European momentum, U.S. exceptionalism remains intact. Europe still grapples with regulatory and labor market challenges, and the potential impact of U.S. tariffs poses significant risks. Overall, while Europe shows promise, the U.S. retains a strong competitive edge in innovation and economic growth.

For a deeper dive into the possibility of a European revival and U.S. exceptionalism, read A growth revival: the start of European exceptionalism? and 7 reasons why U.S. exceptionalism is only being challenged, not overtaken, by Europe.

Investing involves risk, including possible loss of principal. Past Performance does not guarantee future return. All financial investments involve an element of risk. International investing involves greater risks such as currency fluctuations, political/social instability, and differing accounting standards. Equity markets are subject to many factors, including economic conditions, government regulations, market sentiment, local and international political events, and environmental and technological issues that may impact return and volatility.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2025, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

4360012

Select your region to see content specific to your market.

Principal Global Investors, LLC (“Principal Global Investors”) is pleased to provide this website to you subject to your acknowledgement and acceptance of the following Terms of Use. If you disagree with these Terms of Use, you must not use this website.

This website is intended to be made available only to persons and entities residing in the United States. If you do not reside in the United States, please select your appropriate location from the region drop down menu.

License to Use Website

Unless otherwise stated, Principal Global Investors and/or its licensors own the intellectual property rights in the website and material on the website. Subject to the license below, all these intellectual property rights are reserved.

You may view, download for caching purposes only, and print content from the website for your own personal use, subject to the restrictions set out below and elsewhere in these Terms of Use.

You may not (a) republish material from this website (including republication on another website); (b) sell, rent or sub-license material from this website; (c) show any material from this website in public; (d) reproduce, duplicate, copy or otherwise exploit material on this website for a commercial purpose; (e) edit or otherwise modify any material on this website; or (f) redistribute material from this website.

No Investment Advice

This website is for informational purposes only. Nothing contained on this website constitutes tax, accounting, regulatory, legal, insurance or investment advice. This website contains general information only on investment matters and should not be considered as a comprehensive statement on any matter and should not be relied upon as such. The information should not be relied upon as a forecast, research or investment advice. The investments and strategies discussed in the website may not be suitable for all investors. Decisions based on information contained on this website are the sole responsibility of the visitor.

No Solicitation or Offer

Neither the information, nor any opinion, contained on this website constitutes a solicitation or offer by Principal Global Investors or its affiliates to buy or sell any securities, futures, options or other financial instruments, nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the relevant laws of such jurisdiction. All persons and entities accessing this website do so on their own initiative and are responsible for compliance with applicable local laws and regulations.

No Guarantee of Investment Results

Principal Global Investors and its affiliates do not guarantee any investment results and there can be no assurance that the strategies employed will improve investment performance, and make no guarantee that a client's investment objectives will be achieved and no warranties or representations, expressed or implied, are made concerning the benefits of these strategies discussed herein. All investments involve risk and may lose value. The value of your investment can go down depending upon market conditions. Fixed income investments are subject to risk including interest rate, credit, market and issuer risk. Currency exchange rates may cause the value of an investment to go up or down. Alternative strategies involve higher risks than traditional investments, may not be tax efficient, and have higher fees than traditional investments; they may also be highly leveraged and engage in speculative investment techniques, which can magnify the potential for investment loss or gain.

No Guarantee of Timeliness This website may contain videos where the comments were valid on the date the video was recorded. Markets move continuously and you should only rely on current information for any investment decisions. The information and materials contained on this website, and the terms, conditions, and descriptions that appear, are subject to change. All content on this website is presented only as of the date published or indicated, and may be superseded by subsequent market events or for other reasons. In addition, you are responsible for setting the cache settings on your browser to ensure you are receiving the most recent data.

No Warranties

The information on this website has been developed internally and/or obtained from sources believed to be reliable; however Principal Global Investors and its affiliates do not independently verify or guarantee its accuracy or validity. The information and services provided on this website are provided "AS IS" and without warranties of any kind, either expressed or implied. To the fullest extent permissible pursuant to applicable law, Principal Global Investors disclaims all warranties, including, but not limited to, any warranty of non-infringement of third-party rights and any implied warranties of merchantability and fitness for a particular purpose. Principal Global Investors does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained on this website and does not warrant that the functions contained in this website will be uninterrupted or error-free, that defects will be corrected, or that the website will be free of viruses or other harmful components. Principal Global Investors expressly disclaims all liability for errors and omissions in the materials on this website and for the use or interpretation by others of information contained on the website. Subject to any contrary provisions of applicable law, no company in the Principal Financial Group nor any of their employees or directors gives any warranty of reliability or accuracy nor accepts any responsibility arising in any other way (including by reason of negligence) for errors or omissions on this website.

Severability

If any provision of these Terms of Use is deemed unlawful, void, or for any reason unenforceable, then that provision will be deemed severable from these Terms of Use and will not affect the validity and enforceability of the remaining provisions.

No Waiver

No waiver by Principal Global Investors of any right under or term or provision of these Terms of Use will be deemed a waiver of any other right, term, or provision of these Terms of Use at the time of such waiver or a waiver of that or any other right, term, or provision of these Terms of Use at any other time.

Indemnity

In exchange for using this website, you agree to indemnify and hold Principal Global Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to attorneys' fees) arising from your use of this website, from your violation of these terms and conditions or from any decisions that the visitor makes based on such information.

Breaches of these Terms of Use

Without prejudice to Principal Global Investors’ other rights under these Terms of Use, if you breach these Terms of Use in any way, Principal Global Investors may take such action as Principal Global Investors deems appropriate to deal with the breach, including suspending your access to the website, prohibiting you from accessing the website, blocking computers using your IP address from accessing the website, contacting your internet service provider to request that they block your access to the website and bringing court proceedings against you.

Variation

Principal Global Investors may revise these Terms of Use from time to time. Revised Terms of Use will apply to the use of this website from the date of their publication on this website. Please check this page regularly to ensure you are familiar with the current version.

Entire Agreement

These Terms of Use, together with the Principal Financial Group Disclosures, Terms of Use, Privacy and Security links provided below, constitute the entire agreement between you and Principal Global Investors in relation to your use of this website, and supersede all previous agreements in respect of your use of this website.

Law and Jurisdiction

These Terms of Use will be governed by and construed in accordance with Iowa law, and any disputes relating to these Terms of Use will be subject to the exclusive jurisdiction of the courts of Iowa.

If you have questions, please email us.

Click "Accept" to indicate your acknowledgement and acceptance of Principal Global Investors Terms of Use and to continue.

Principal Global Investors, LLC, the issuer of this website, does not hold a Singapore Capital Markets Services licence or any Securities and Futures Commission licences in Hong Kong. This website contains general information only on investment matters and nothing in this website is intended to constitute an offer or inducement to provide capital markets products and services to Singapore investors or any investment services to Hong Kong investors.

The information in the following website should not be construed as investment advice or a recommendation for the purchase or sale of any security. The value of investments and the income from them may fall as well as rise. Principal Global Investors, LLC and the other member firms of Principal Global Investors (collectively, the “Firms”)* do not guarantee any investment results and there can be no assurance that the strategies employed will improve investment performance, and make no guarantee that a client’s investment objectives will be achieved and no warranties or representations, expressed or implied, are made by the Firms concerning the benefits of these strategies discussed herein. The information in this website has been developed internally and/or obtained from sources that the Firms believe to be reliable; however, the Firms do not guarantee the accuracy, adequacy or completeness of such information and are not responsible for any errors or omissions. This website also contains videos where the comments were valid on the date the video was recorded. Markets move continuously and you should only rely on current information.

It contains general information only on investment matters and should not be considered as a comprehensive statement on any matter and should not be relied upon as such nor should it be construed as specific investment advice, an opinion or recommendation. Products and services mentioned in this website may or may not be registered in your jurisdiction for retail distribution or suitable for all types of investors. The general information it contains does not take account of any investor›s investment objectives, particular needs or financial situation, nor should it be relied upon in any way as a forecast or guarantee of future events regarding investment or the markets in general. All expressions of opinion and prediction in this website are subject to change without notice. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security.

Past performance is not a reliable indicator of future performance and should not be relied upon as a significant basis for an investment decision. You should consider whether an investment fits your investment objectives, particular needs and financial situation before making any investment decision.

Access to this website and its content is only permitted for “institutional investors” in Singapore within the meaning given to that term in section 4A of the Securities and Futures Act 2001 (“Act”) or “Professional Investors” in Hong Kong within the meaning given to that term under the Securities and Futures Ordinance. It is not intended for any retail investors.

The website may contain information on funds that are registered as restricted schemes under the Sixth Schedule to the Securities and Futures (Offers of Investments) (Collective Investment Schemes) Regulations in Singapore. The offer, holding and subsequent transfer of shares are subject to restrictions and conditions stipulated under the Act and the units in those funds are not allowed to be offered to the retail public. The shares of these funds are being offered only on the basis of the information contained in the relevant Information Memorandum. The Information Memorandum is not a prospectus as defined in the Act and accordingly, statutory liability under the Act in relation to the content of prospectuses does not apply. The Monetary Authority of Singapore has not, in any way, considered the investment merits of the funds and assumes no responsibility for the contents of the website and/or that of the Information Memorandum.

It is your responsibility to be aware of and to observe all applicable laws and regulations of any relevant jurisdiction. If you are not an “institutional investor” in Singapore or a “Professional Investor” in Hong Kong you may not access this website and you should select the “I Do Not Accept” button below.

By selecting the “Accept” button below, and entering this website, you are representing and warranting that the applicable laws and regulations of your jurisdiction allow you to access the website and that you have agreed to these terms and confirm and represent that you are an “institutional investor” in Singapore or a “Professional Investor” in Hong Kong."

Principal Global Investors (Australia) Ltd. (ABN 45 102 488 068, AFS Licence No. 225385) ("we", "us", "our") is regulated by the Australian Securities and Investments Commission.

The information in this website, and on pages linked by this website, is general information only and is not intended to constitute financial product advice or a recommendation to buy, sell or hold any particular security or investment. It does not take into account any investor's investment objectives, particular needs or financial situation. Any investor should consider whether an investment fits their investment objectives, particular needs and financial situation before making any investment decision.

While the information on this website is updated from time to time, it is subject to change in the intervening period. None of Principal Global Investors (Australia) Limited or its related entities (together "Principal") guarantee the accuracy, completeness or timeliness of the information on this website. Information may become outdated and opinions may change, including as a result of new information becoming available or changes in the markets. To the extent permitted by law, Principal does not accept any responsibility arising in any way (including by reason of negligence) for errors in, or omissions from, this information.

We offer financial products only to wholesale investors (as defined in sections 761G and 761GA of the Corporations Act) and to persons investing through an investor directed portfolio service under the product disclosure statements that can be accessed from this website.

The information contained in this website is intended only for Australian residents and investors and is not intended for use in any country or jurisdiction where such use would constitute a violation of law. There is no intention to offer or sell products in countries or jurisdictions where such offer or sale would be unlawful under the relevant domestic law.

Protecting Your Privacy

At Principal Global Investors (Australia) Ltd, we give priority to protecting the privacy of your personal information. We do this by handling personal information in a responsible manner and in accordance with the Privacy Act 1988 (Cth).

If it is reasonable and practicable to do so, we collect personal information directly from you. How we collect your information will depend upon how you interact with us. We may collect it through application forms, telephone, email and internet contact, from correspondence with you or your consultant and in person.

The information collected may include what time you visited our website, how long you were on our site, if you've been to the site before, what web pages you visited, and what type of browser you used to access our website. This information is collected through the use of cookies.

Use of cookies on this site is outlined in the Principal Online Privacy Policies, Information Collected by Use of Cookies and Spotlight Tags. In accepting these terms and conditions, you accept the terms of the use of cookies from this site. You can configure your browser to accept all cookies, reject all cookies, or notify you when a cookie is sent. Refer to your browser instructions or help screens to learn about these functions. If you reject all cookies, you may not be able to use our web sites.

We may collect, hold and use personal information in order to process applications, administer the investments and provide related services. If you do not provide your personal information to us, we may not be able to process and administer your investment. We may also use your personal information to tell you about other products and services offered by us or other members of the Principal Financial Group. Please contact us if you do not wish to receive this ongoing information.

We may disclose your personal information to other related companies within the Principal Financial Group®, agents and other external service providers (who supply administrative, financial or other services), some of which are located overseas. Where this occurs, we take steps to protect personal information against misuse or loss however you should be aware that in the event the overseas recipient fails to handle the personal information consistently with the Australian Privacy Principles, we will not be accountable under the Privacy Act and you will not be able to seek redress under the Act. The countries this information may be disclosed to will vary from time to time, but may include Brazil, Chile, China, Hong Kong, India, Japan, Malaysia, Singapore, the United Kingdom and the United States and other countries where the Principal Financial Group® has a presence. A list of locations in which the Principal Financial Group® operates can be found at https://www.principal.com/about-us/our-company/company-overview/worldwide-locations. Our Privacy Policy contains information about how you can gain access to the personal information that we hold about you and seek correction of that information, subject to certain exemptions under law. Our Privacy Policy also contains information about how you may raise concerns regarding privacy with us and how we will deal with your concerns.

You can obtain a copy of our Privacy Policy by clicking on the link below:

Privacy at Principal Global Investors (Australia) Limited

By clicking "Accept", you consent to us dealing with your personal information in the manner set out in our Privacy Policy. You also acknowledge and understand that by providing such consent that we will not be required to take such steps as are reasonable in the circumstances to ensure overseas recipients of your personal information comply with the Australian Privacy Principles.

"Principal Financial Group is a global organization that operates in many different jurisdictions worldwide. Principal Financial Group’s diversified group of companies and affiliates provide comprehensive asset management solutions for institutional investors, investment funds and individuals in key markets around the world. Principal Financial Group has investment offices in the United States, [Mexico, South America, Europe, the Middle East, and throughout Asia]. Where appropriate, Principal Financial Group entities are registered with appropriate regulatory authorities in the jurisdictions in which they are required to be registered to carry on their respective business activities.

All products or services provided to you by any Principal Financial Group company shall only be available in the jurisdiction(s) within which the company providing the product or service is authorized to operate. The relevant Principal Financial Group company reserves the right to make the final determination on whether or not you are eligible for any particular product or service. If you choose to enter a website outside your country of residence, you are advised that it may not be legal in that jurisdiction for you to access or use the facilities available on that Site and the legal requirements of that jurisdiction may prohibit you from dealing or otherwise transacting in that jurisdiction.

Principal Financial Group makes no representation that the content of the site is appropriate for use in all locations, or that the transactions, securities, products, instruments or services discussed at this site are available or appropriate for sale or use in all jurisdictions or countries, or by all persons and entities. Nothing on this website shall be considered a solicitation for the offering of any investment product or service to any person in any jurisdiction where such solicitation or offering may not lawfully be made.

Principal Global Investors, LLC (“Principal Global Investors”) is pleased to provide this website to you subject to your acknowledgement and acceptance of the following Terms of Use. If you disagree with these Terms of Use, you must not use this website.

License to Use Website

Unless otherwise stated, Principal Global Investors and/or its licensors own the intellectual property rights in the website and material on the website. Subject to the license below, all these intellectual property rights are reserved.

You may view, download for caching purposes only, and print content from the website for your own personal use, subject to the restrictions set out below and elsewhere in these Terms of Use.

You may not (a) republish material from this website (including republication on another website); (b) sell, rent or sub-license material from this website; (c) show any material from this website in public; (d) reproduce, duplicate, copy or otherwise exploit material on this website for a commercial purpose; (e) edit or otherwise modify any material on this website; or (f) redistribute material from this website.

No Investment Advice

This website is for informational purposes only. Nothing contained on this website constitutes tax, accounting, regulatory, legal, insurance or investment advice. This website contains general information only on investment matters and should not be considered as a comprehensive statement on any matter and should not be relied upon as such. The information should not be relied upon as a forecast, research or investment advice. The investments and strategies discussed in the website may not be suitable for all investors. Decisions based on information contained on this website are the sole responsibility of the visitor.

No Solicitation or Offer

Neither the information, nor any opinion, contained on this website constitutes a solicitation or offer by Principal Global Investors or its affiliates to buy or sell any securities, futures, options or other financial instruments, nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the relevant laws of such jurisdiction. All persons and entities accessing this website do so on their own initiative and are responsible for compliance with applicable local laws and regulations.

No Guarantee of Investment Results

Principal Global Investors and its affiliates do not guarantee any investment results and there can be no assurance that the strategies employed will improve investment performance, and make no guarantee that a client's investment objectives will be achieved and no warranties or representations, expressed or implied, are made concerning the benefits of these strategies discussed herein. All investments involve risk and may lose value. The value of your investment can go down depending upon market conditions. Fixed income investments are subject to risk including interest rate, credit, market and issuer risk. Currency exchange rates may cause the value of an investment to go up or down. Alternative strategies involve higher risks than traditional investments, may not be tax efficient, and have higher fees than traditional investments; they may also be highly leveraged and engage in speculative investment techniques, which can magnify the potential for investment loss or gain.

No Guarantee of Timeliness

This website may contain videos where the comments were valid on the date the video was recorded. Markets move continuously and you should only rely on current information for any investment decisions. The information and materials contained on this website, and the terms, conditions, and descriptions that appear, are subject to change. All content on this website is presented only as of the date published or indicated, and may be superseded by subsequent market events or for other reasons. In addition, you are responsible for setting the cache settings on your browser to ensure you are receiving the most recent data.

No Warranties

The information on this website has been developed internally and/or obtained from sources believed to be reliable; however Principal Global Investors and its affiliates do not independently verify or guarantee its accuracy or validity. The information and services provided on this website are provided ""AS IS"" and without warranties of any kind, either expressed or implied. To the fullest extent permissible pursuant to applicable law, Principal Global Investors disclaims all warranties, including, but not limited to, any warranty of non-infringement of third-party rights and any implied warranties of merchantability and fitness for a particular purpose. Principal Global Investors does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained on this website and does not warrant that the functions contained in this website will be uninterrupted or error-free, that defects will be corrected, or that the website will be free of viruses or other harmful components. Principal Global Investors expressly disclaims all liability for errors and omissions in the materials on this website and for the use or interpretation by others of information contained on the website. Subject to any contrary provisions of applicable law, no company in the Principal Financial Group nor any of their employees or directors gives any warranty of reliability or accuracy nor accepts any responsibility arising in any other way (including by reason of negligence) for errors or omissions on this website.

Severability

If any provision of these Terms of Use is deemed unlawful, void, or for any reason unenforceable, then that provision will be deemed severable from these Terms of Use and will not affect the validity and enforceability of the remaining provisions.

No Waiver

No waiver by Principal Global Investors of any right under or term or provision of these Terms of Use will be deemed a waiver of any other right, term, or provision of these Terms of Use at the time of such waiver or a waiver of that or any other right, term, or provision of these Terms of Use at any other time.

Indemnity

In exchange for using this website, you agree to indemnify and hold Principal Global Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to attorneys' fees) arising from your use of this website, from your violation of these terms and conditions or from any decisions that the visitor makes based on such information.

Breaches of these Terms of Use

Without prejudice to Principal Global Investors’ other rights under these Terms of Use, if you breach these Terms of Use in any way, Principal Global Investors may take such action as Principal Global Investors deems appropriate to deal with the breach, including suspending your access to the website, prohibiting you from accessing the website, blocking computers using your IP address from accessing the website, contacting your internet service provider to request that they block your access to the website and bringing court proceedings against you.

Variation

Principal Global Investors may revise these Terms of Use from time to time. Revised Terms of Use will apply to the use of this website from the date of their publication on this website. Please check this page regularly to ensure you are familiar with the current version.

Entire Agreement

These Terms of Use, together with the Principal Financial Group Disclosures, Terms of Use, Privacy and Security links provided below, constitute the entire agreement between you and Principal Global Investors in relation to your use of this website, and supersede all previous agreements in respect of your use of this website.

If you have questions, please email us.

Click ""Accept"" to indicate your acknowledgement and acceptance of Principal Global Investors Terms of Use and to continue."

"These Terms & Conditions explain certain legal and regulatory conditions and restrictions in relation to the Principal Global Investors (Europe) Limited website, and in relation to the Principal Global Investors Funds (‘the Funds’). This information may be changed by Principal Global Investors at any time without notice.

In these terms and conditions, references to 'Principal Global Investors' means Principal Global Investors (Europe) Limited or any affiliate of the Principal Financial Group, Inc. or Principal Global Investors, LLC.

Before you proceed, you must acknowledge that you have read, and agree to, our terms and conditions.

Information in relation to the Principal Global Investors Funds is available through this web site to institutional investors resident in the following countries of: Belgium, France, Finland, Germany, Guernsey, Ireland, Italy, Jersey, Netherlands, Spain, Sweden, Switzerland and the United Kingdom. By proceeding this far you are representing and warranting that you are an institutional investor resident in one of these countries. Not all of the Funds are available in all these jurisdictions, and investors are directed to the Country Registration document for detailed information. What follows is not an offer or invitation to acquire an investment to, and should therefore not be relied upon by, any person anywhere other than the countries noted. Persons in respect of whom such prohibitions apply must not access this web site. This web site is reserved exclusively for non-U.S. persons and should not be accessed by any person in the United States.

Yes, I certify to be an institutional investor and resident of a country listed above.

Cookies

Use of cookies on this site is outlined in the Privacy and Security Policy. In accepting these terms and conditions, you accept the terms of the Cookie Policy and the use of cookies from this site.

Legal Entity Disclosure and Regulation

In Europe by Principal Global Investors (Ireland) Limited, 70 Sir John Rogerson’s Quay, Dublin 2, D02 R296, Ireland. Principal Global Investors (Ireland) Limited is regulated by the Central Bank of Ireland.

In the United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorised and regulated by the Financial Conduct Authority (“FCA”).

In Switzerland by Principal Global Investors (Switzerland) GmbH. This website is considered as advertising and information contained herewith be treated as such. Investors can obtain free of charge the prospectus, trust deed, the prospectus, the key investor information document (KIID), and the annual and semi-annual reports from the representative in Switzerland.

In Europe and United Kingdom, this website is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID and FCA respectively). If you are viewing the material as a retail investor, you should seek independent investment advice before deciding whether the products and services in question are suitable to meet your investment needs and objectives, as the language has not been complied to a retail client standard.

Principal Global Investors Funds

Principal Global Investors (Ireland) Limited is the issuer of the Funds. Investments may only be made on an application form attached to a current prospectus and following receipt by the investor of the KIID in respect of the Fund in which they intend to invest. The latest version of the prospectus of the Funds is dated 14 December 2012.

For Real estate investors in the European Economic Area (“EEA”), this website and the information on it is only directed at persons who are professional investors for the purposes of the Alternative Investment Fund Managers Directive (2011/61/EU) (“AIFMD”), professional clients or eligible counterparties for the purposes of the Markets in Financial Instruments Directive (Directive 2014/65/EU) (“MiFID II”) or as otherwise defined under applicable local law and regulation and at whom this website and the information on it may lawfully be directed in any relevant jurisdiction (“Eligible Persons”). In relation to each member state of the EEA (“Member State”) which has implemented AIFMD (and for which transitional arrangements are not/ no longer available), this website may only be accessed and interests in Funds may only be offered or placed in a Member State to the extent that: (i) the relevant Fund is permitted to be marketed to professional investors in the relevant Member State in accordance with AIFMD (as implemented into the local law/regulation of the relevant Member State); or (ii) this website and its information may otherwise be lawfully distributed and the interests in Funds may otherwise be lawfully offered or placed in that Member State (including at the initiative of the investor). In relation to each Member State of the EEA which, at the date of accessing this website, has not implemented AIFMD, this information may only be distributed and interests in Funds may only be offered or placed to the extent that this information may be lawfully distributed and the interests in Funds may lawfully be offered or placed in that Member State (including at the initiative of the investor).

Persons who are not Eligible Persons, including but not limited to those individuals or other persons who fall within the FCA’s definition of ‘retail clients’, should not use or rely upon this website or the information contained therein and may not engage the services of Principal Real Estate or any of its affiliates, or invest in any Fund. Potential investors are advised that all or most of the protections provided by the UK regulatory system will not apply and that the UK Financial Services Compensation Scheme may not be available in relation to an investment in a Fund or separate account.

The contents of this website have not been verified or approved by any competent regulatory or supervisory authority. No liability, whether in negligence or otherwise, arising directly or indirectly from the use of the information or any part of it on this website is accepted and no representation, warranty or undertaking, whether express or implied, is or will be made at any time by Principal Real Estate or its affiliates or any of their respective advisers, directors, officers, employees, representatives or other agents (“Principal Agents”) for any information or any of the opinions contained herein or for any errors, omissions or misstatements.

None of Principal Real Estate or its affiliates or any Principal Agents makes or has been authorised to make any representation or warranties, whether express or implied, in relation to Principal Real Estate or regarding the truth, accuracy or completeness of any of the information contained on this website at any time. No representation or warranty is given by Principal Real Estate, its affiliates or the Principal Agents as to the achievement or reasonableness of, and no reliance should be placed on any projections, targets, estimates or forecasts contained in the information on this website. Furthermore, nothing contained on this website is or should be relied on as a promise or representation as to the future. No reliance may be placed by any person for any purpose whatsoever on the information or opinions contained on this website or on its completeness, accuracy or fairness at any time.

Principal Global Investors (Europe) Limited is not authorised by the FCA to directly deal with retail investors; any distribution of the Fund to retail investors in Europe is facilitated by fund distributors with which Principal Global Investors (Europe) Limited has entered distribution arrangements, pursuant to advice provided to investors by those distributors, based on the documents Principal Global Investors (Europe) Limited provides. Retail investors should not be provided with access to this website.

The name of the Swiss representative is ACOLIN Fund Services AG, Stadelhoferstrasse 18, CH-8001 Zürich. The name of the Swiss paying agent is Banque Cantonale de Genève, 17, quai de l’Ile, 1204 Geneva. Investors can obtain the prospectus, trust deed, the simplified prospectuses and the annual and semi-annual reports free of charge from the representative in Switzerland.

The value of units and the income from them may fall as well as rise.

Investments in the Funds are neither insured nor guaranteed by the US Government or the Federal Deposit Insurance Corporation and are not deposits or obligations of, or guaranteed by, Principal Global Investors.

No Solicitation

Nothing contained in this website shall constitute an offer or solicitation, in relation to units in the Funds or generally, in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or not authorised.

In particular, shares issued by the Company, and units in the Funds, have not been and will not be registered under the United States Securities Act of 1933 as amended or the securities laws of any state or political subdivision of the United States and may not, except in a transaction which does not violate US securities laws, be directly offered or sold in the United States or to any US Person. The Company will not be registered under the United States Investment Company Act of 1940 as amended.

This website is reserved exclusively for non-US persons and should not be accessed by any person in the United States.

No Investment Advice

The information in this website contains general information only on investment matters and should not be considered as a comprehensive statement on any matter and should not be relied upon as such nor should it be construed as specific investment advice, an opinion or recommendation. The general information it contains does not take account of any investor’s investment objectives, particular needs or financial situation, nor should it be relied upon in any way as a forecast or guarantee of future events regarding a particular investment or the markets in general. Past performance is not a reliable indicator of future performance and should not be relied upon as a significant basis for an investment decision.

You should also inform yourself as to (a) the possible tax consequences, (b) the legal requirements and (c) any foreign exchange restrictions or exchange control requirements which you might encounter under the laws of the countries of your citizenship, residence or domicile and which might be relevant to any investment, including the subscription, holding, transfer or disposal of units in the Funds

Delegation of Investment Management to Affiliates

Products upon which composite results contained in this material, if any, are based may not themselves be available in the United Kingdom and certain other jurisdictions; however, the underlying investment management capability can be made available to institutional investors subject to all applicable local regulations and restrictions. In connection with its management of client portfolios, PGIE may delegate management authority to affiliates that are not authorised and regulated by the Financial Conduct Authority. In any such case, the client may not benefit from all protections afforded by rules and regulations enacted under the Financial Services and Markets Act 2000.

Disclaimer

The information on this website is given by Principal Global Investors in good faith and has been derived from sources believed to be reliable and accurate as at their date. However, Principal Global Investors makes no representation or warranty of any kind for the accuracy or completeness of the information and it is under no obligation to update or correct any errors in the information after the date of publication. This website also contains videos where the comments were valid on the date the video was recorded. Markets move continuously and you should only rely on current information for any investment decisions.

Subject to applicable law, Principal Global Investors and its affiliates and their respective directors, employees and associates do not accept any responsibility arising in any way (including by reason of negligence) for errors in, or omissions from, the information and do not accept any liability for any loss or damage, however caused, as a result of any person relying on any information on the website or being unable to access the website.

The Internet is not a totally reliable and secure medium of communication. Principal Global Investors accepts no liability for the security or confidentiality of information transmitted in this way and any such transmission of information shall be at your own risk.

The entire content of this website is subject to copyright with all rights reserved. You may not copy, reproduce, distribute or modify the content of this website without the prior written permission of Principal Global Investors.

No instructions for investment purposes will be accepted directly from this website or by e-mail.

If you accept these terms and conditions, click “Accept.”

You are about to leave PrincipalAM.com and be directed to our Japanese site, PrincipalGlobal.jp. If you wish to proceed, please click "Accept." If you would like to stay on PrincipalAM.com, please click "I do not accept."

"Principal Financial Group is a global organization that operates in many different jurisdictions worldwide. Principal Financial Group’s diversified group of companies and affiliates provide comprehensive asset management solutions for institutional investors, investment funds and individuals in key markets around the world. Principal Financial Group has investment offices in the United States, [Mexico, South America, Europe, the Middle East, and throughout Asia]. Where appropriate, Principal Financial Group entities are registered with appropriate regulatory authorities in the jurisdictions in which they are required to be registered to carry on their respective business activities.

All products or services provided to you by any Principal Financial Group company shall only be available in the jurisdiction(s) within which the company providing the product or service is authorized to operate. The relevant Principal Financial Group company reserves the right to make the final determination on whether or not you are eligible for any particular product or service. If you choose to enter a website outside your country of residence, you are advised that it may not be legal in that jurisdiction for you to access or use the facilities available on that Site and the legal requirements of that jurisdiction may prohibit you from dealing or otherwise transacting in that jurisdiction.

Principal Financial Group makes no representation that the content of the site is appropriate for use in all locations, or that the transactions, securities, products, instruments or services discussed at this site are available or appropriate for sale or use in all jurisdictions or countries, or by all persons and entities. Nothing on this website shall be considered a solicitation for the offering of any investment product or service to any person in any jurisdiction where such solicitation or offering may not lawfully be made.

Principal Global Investors, LLC (“Principal Global Investors”) is pleased to provide this website to you subject to your acknowledgement and acceptance of the following Terms of Use. If you disagree with these Terms of Use, you must not use this website.

License to Use Website

Unless otherwise stated, Principal Global Investors and/or its licensors own the intellectual property rights in the website and material on the website. Subject to the license below, all these intellectual property rights are reserved.

You may view, download for caching purposes only, and print content from the website for your own personal use, subject to the restrictions set out below and elsewhere in these Terms of Use.

You may not (a) republish material from this website (including republication on another website); (b) sell, rent or sub-license material from this website; (c) show any material from this website in public; (d) reproduce, duplicate, copy or otherwise exploit material on this website for a commercial purpose; (e) edit or otherwise modify any material on this website; or (f) redistribute material from this website.

No Investment Advice

This website is for informational purposes only. Nothing contained on this website constitutes tax, accounting, regulatory, legal, insurance or investment advice. This website contains general information only on investment matters and should not be considered as a comprehensive statement on any matter and should not be relied upon as such. The information should not be relied upon as a forecast, research or investment advice. The investments and strategies discussed in the website may not be suitable for all investors. Decisions based on information contained on this website are the sole responsibility of the visitor.

No Solicitation or Offer

Neither the information, nor any opinion, contained on this website constitutes a solicitation or offer by Principal Global Investors or its affiliates to buy or sell any securities, futures, options or other financial instruments, nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the relevant laws of such jurisdiction. All persons and entities accessing this website do so on their own initiative and are responsible for compliance with applicable local laws and regulations.

No Guarantee of Investment Results

Principal Global Investors and its affiliates do not guarantee any investment results and there can be no assurance that the strategies employed will improve investment performance, and make no guarantee that a client's investment objectives will be achieved and no warranties or representations, expressed or implied, are made concerning the benefits of these strategies discussed herein. All investments involve risk and may lose value. The value of your investment can go down depending upon market conditions. Fixed income investments are subject to risk including interest rate, credit, market and issuer risk. Currency exchange rates may cause the value of an investment to go up or down. Alternative strategies involve higher risks than traditional investments, may not be tax efficient, and have higher fees than traditional investments; they may also be highly leveraged and engage in speculative investment techniques, which can magnify the potential for investment loss or gain.

No Guarantee of Timeliness

This website may contain videos where the comments were valid on the date the video was recorded. Markets move continuously and you should only rely on current information for any investment decisions. The information and materials contained on this website, and the terms, conditions, and descriptions that appear, are subject to change. All content on this website is presented only as of the date published or indicated, and may be superseded by subsequent market events or for other reasons. In addition, you are responsible for setting the cache settings on your browser to ensure you are receiving the most recent data.

No Warranties

The information on this website has been developed internally and/or obtained from sources believed to be reliable; however Principal Global Investors and its affiliates do not independently verify or guarantee its accuracy or validity. The information and services provided on this website are provided ""AS IS"" and without warranties of any kind, either expressed or implied. To the fullest extent permissible pursuant to applicable law, Principal Global Investors disclaims all warranties, including, but not limited to, any warranty of non-infringement of third-party rights and any implied warranties of merchantability and fitness for a particular purpose. Principal Global Investors does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained on this website and does not warrant that the functions contained in this website will be uninterrupted or error-free, that defects will be corrected, or that the website will be free of viruses or other harmful components. Principal Global Investors expressly disclaims all liability for errors and omissions in the materials on this website and for the use or interpretation by others of information contained on the website. Subject to any contrary provisions of applicable law, no company in the Principal Financial Group nor any of their employees or directors gives any warranty of reliability or accuracy nor accepts any responsibility arising in any other way (including by reason of negligence) for errors or omissions on this website.

Severability

If any provision of these Terms of Use is deemed unlawful, void, or for any reason unenforceable, then that provision will be deemed severable from these Terms of Use and will not affect the validity and enforceability of the remaining provisions.

No Waiver

No waiver by Principal Global Investors of any right under or term or provision of these Terms of Use will be deemed a waiver of any other right, term, or provision of these Terms of Use at the time of such waiver or a waiver of that or any other right, term, or provision of these Terms of Use at any other time.

Indemnity

In exchange for using this website, you agree to indemnify and hold Principal Global Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to attorneys' fees) arising from your use of this website, from your violation of these terms and conditions or from any decisions that the visitor makes based on such information.

Breaches of these Terms of Use

Without prejudice to Principal Global Investors’ other rights under these Terms of Use, if you breach these Terms of Use in any way, Principal Global Investors may take such action as Principal Global Investors deems appropriate to deal with the breach, including suspending your access to the website, prohibiting you from accessing the website, blocking computers using your IP address from accessing the website, contacting your internet service provider to request that they block your access to the website and bringing court proceedings against you.

Variation

Principal Global Investors may revise these Terms of Use from time to time. Revised Terms of Use will apply to the use of this website from the date of their publication on this website. Please check this page regularly to ensure you are familiar with the current version.

Entire Agreement

These Terms of Use, together with the Principal Financial Group Disclosures, Terms of Use, Privacy and Security links provided below, constitute the entire agreement between you and Principal Global Investors in relation to your use of this website, and supersede all previous agreements in respect of your use of this website.

If you have questions, please email us.

Click ""Accept"" to indicate your acknowledgement and acceptance of Principal Global Investors Terms of Use and to continue."

This website contains general information only on investment matters and nothing in this website is intended to constitute or form part of any offer or inducement to issue or sell, or any solicitation of any offer to subscribe for or purchase, any securities or investment products in the UAE (including the Dubai International Financial Centre) and accordingly should not be construed as such. Information in this website is not directed at you if we are prohibited by any law of any jurisdiction from making the information on this site available to you and is not intended for any use that would be contrary to local law or regulation. Products or services mentioned on this site are subject to legal and regulatory requirements in applicable jurisdictions and may not be available in all jurisdictions. Accordingly, persons are required to inform themselves of and observe any such restrictions.

The information in this website is being made available on the basis that the recipient acknowledges and understands that the entities and securities to which it may relate have not been approved, licensed by or registered with the UAE Central Bank, the Dubai Financial Services Authority or any other relevant licensing authority or governmental agency in the UAE or elsewhere in the Middle East.

The information in the following website should not be construed as investment advice or a recommendation for the purchase or sale of any security. The value of investments and the income from them may fall as well as rise. Principal Investor Management (DIFC) Limited and the other member firms of Principal (collectively, the “Firms”) do not guarantee any investment results and there can be no assurance that the strategies employed will improve investment performance, and make no guarantee that a client’s investment objectives will be achieved and no warranties or representations, expressed or implied, are made by the Firms concerning the benefits of these strategies discussed herein. The information in this website has been developed internally and/or obtained from sources that the Firms believe to be reliable; however, the Firms do not guarantee the accuracy, adequacy or completeness of such information and are not responsible for any errors or omissions. This website also contains videos where the comments were valid on the date the video was recorded. Markets move continuously and you should only rely on current information for any investment decisions.

This website contains general information only on investment matters and should not be considered as a comprehensive statement on any matter and should not be relied upon as such. The information it contains does not take account of any investor’s investment objectives, particular needs or financial situation. Past performance is not a reliable indicator of future performance and should not be relied upon as a significant basis for an investment decision. You should consider whether an investment fits your investment objectives, particular needs and financial situation before making any investment decision.

Nothing in this website should be construed as investment, tax, legal or other advice.

The content of this website has not been approved by or filed with the UAE Central Bank or Dubai Financial Services Authority.

Access to this website is only permitted for “Professional Clients” as defined in the Conduct of Business of the Dubai Financial Services Authority’s Rulebook. If you are not a “Professional Client”, you may not access this website and you should select the “Decline” link below.

By selecting the “Accept” button below, and entering this website, you agree to these terms and confirm and represent that you are a “Professional Client”.