The narrowness of the equity rally to date remains a concern for investors. While the Magnificent 7 may not enjoy the same outperformance as earlier this year, solid earnings growth should assure continued equity gains. With the strong economic backdrop promoting a broadening of returns in the second half of 2024, investors can look to companies, sectors, and markets with meaningfully less stretched valuations to continue to fuel the equity market rally.

The stock market and earnings

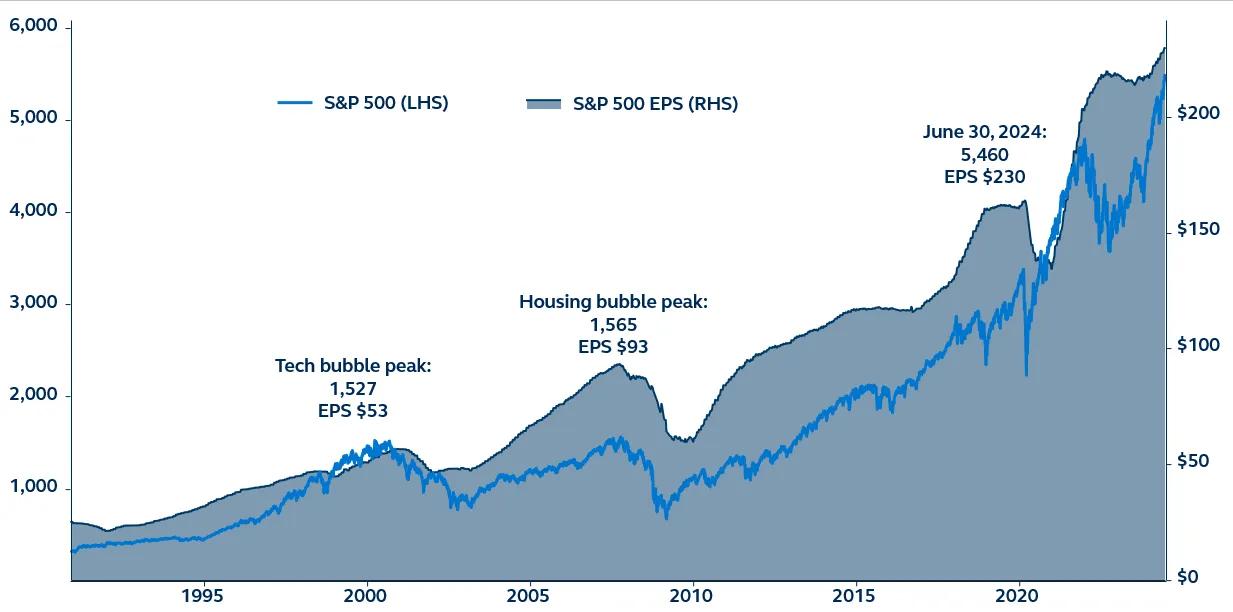

S&P 500 Index price and trailing earnings-per-share, 1990–present

Prospects for significant interest rate cuts were an important driver of the market rally in the first half of 2024. Yet that same economic strength that has delayed Fed cuts should support a positive backdrop for corporate earnings, ensuring that the setup for equities remains constructive, even if gains are not as strong as earlier in the year.

Historically, long Fed pauses have been positive for stocks. In fact, the 1995–1996 Fed pause was against a similar backdrop to the present day, with strong economic growth giving the Fed little reason to lower rates. During that period, the Fed kept policy rates on hold, the S&P 500 rose 19.2%.

The narrowness of market gains remains a concern, with the equity rally seemingly hostage to the performance of Magnificent 7 technology stocks. Yet, the AI craze and delivery of strong earnings means that investors are still willing to pay higher multiples for those companies. Stretched valuations and very concentrated positioning may imply the Magnificent 7 only grind higher from here, but the secular trend upwards should persist over the long run. Furthermore, solid economic growth should support a broadening out of risk appetite and earnings growth across a variety of other companies, sectors, and markets which are meaningfully less stretched and, therefore, offer the potential for strong returns.

Read more about additional themes impacting markets and portfolios in the quarter ahead in our 3Q Global Market Perspectives.

Investing involves risk, including possible loss of Principal. Past Performance does not guarantee future return.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers. Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations. In Europe, this communication is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3730615