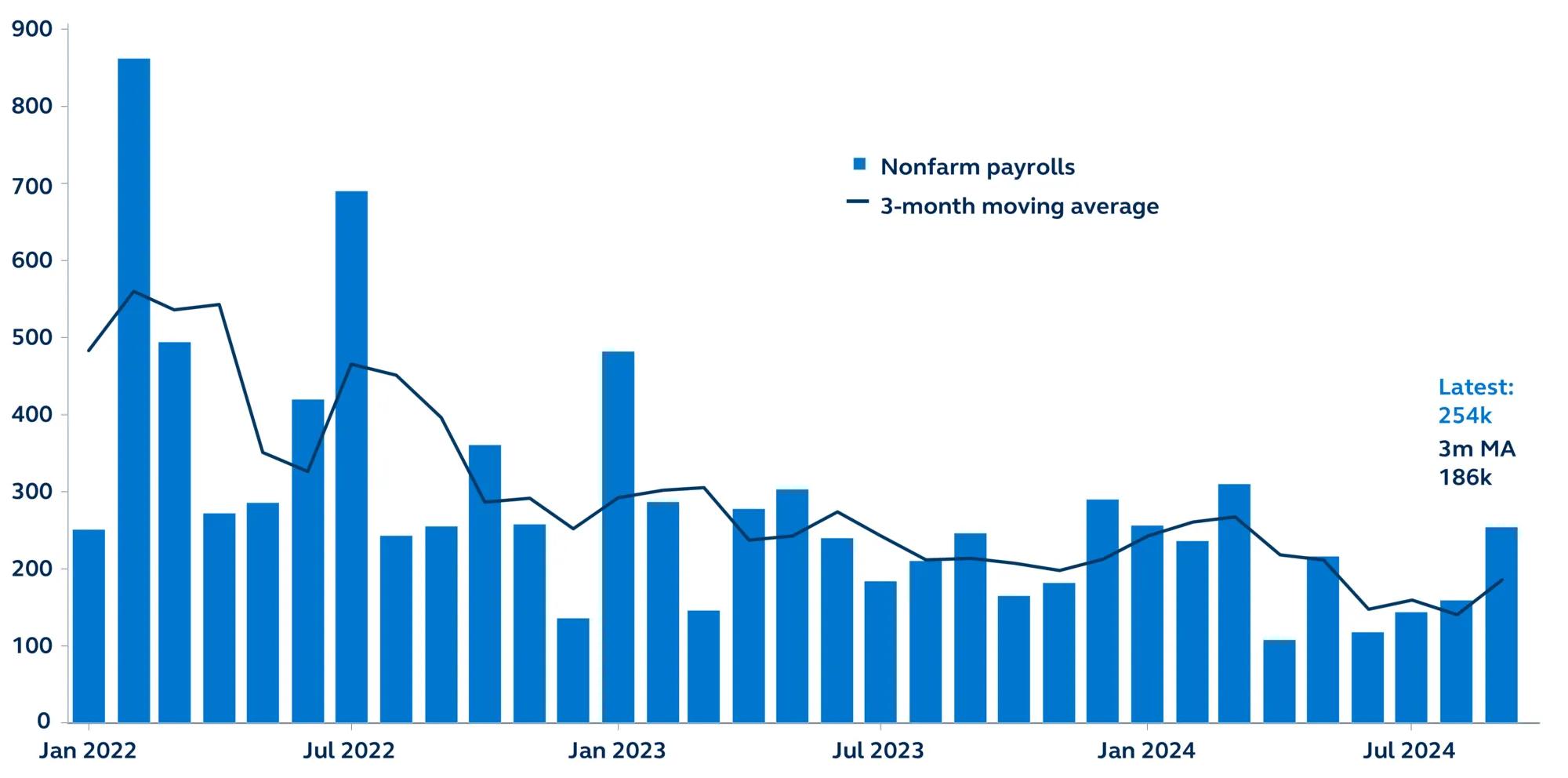

The September jobs report showed a 254,000 monthly job gain, blowing all estimates out of the water. Not only does it suggest that the U.S. labor market is on a stronger footing than most believed, but it also suggests that the Fed does not need to maintain such an aggressive pace of rate cuts. Market expectations for a 50bps cut in November have rightfully plunged, and a 25bps reduction is now the clear market consensus.

Non-farm payrolls

Thousands, January 2022–present

Report details

- Total non-farm payrolls increased by 254,000 in September, well above expectations, rebounding from the upwardly revised 159,000 rate last month. Solid employment growth this month signals a potentially more robust labor market than was previously assumed, especially as payrolls grew more than the average monthly gain over the past year.

- Job gains were evident across both structural and cyclical sides of the economy. Healthcare and government have continued to benefit from a catch-up in hiring. However, monthly gains for both have slowed in recent months, particularly as staffing levels gradually return to their pre-pandemic trend. Meanwhile, job growth was also robust within leisure and hospitality, and construction, the former likely supported by still healthy consumer demand and the latter by the steady decline in mortgage rates. Overall, these sectors made up nearly 85% of total payroll growth.

- The unemployment rate declined unexpectedly to 4.1%, helped by reduced layoff activity and new labor supply. While the participation rate held steady at 62.7% for the third straight month, participation for prime-age workers (aged 25-54) declined to 83.8%.

- Average hourly earnings accelerated by 0.4% in the month, which was higher than expected, bringing the annual rate to 4.0%, an increase from the prior month’s upwardly revised 3.9%. Despite other data pointing to normalization in the imbalance between labor supply and demand, earnings growth has remained elevated, indicating that workers still have bargaining power, with the three-month annualized rise in wages picking up to 4.3%.

Policy outlook

The strength of today’s jobs report will inevitably raise questions about whether the Fed even needed to cut rates in September, let alone by 50bps. Yet, the central bank will likely feel encouraged by the September payroll report, giving support to the idea that the Fed is ahead of the curve and raising the probability of a soft landing. It is highly unlikely to halt its cutting cycle in response to today’s data.

Markets will now need to pay closer attention to inflation. The U.S. economy may be on a stronger footing than the Fed initially believed, and although jobs data is notoriously volatile, there will be concerns that continued Fed easing could reignite inflation pressures.

Our view remains for 25bps cuts in November and December, followed by a gradual easing through 2025 as the Fed secures a soft economic landing.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information in the article should not be construed as investment advice or a recommendation for the purchase or sale of any security. The general information it contains does not take account of any investor’s investment objectives, particular needs, or financial situation.

3915570